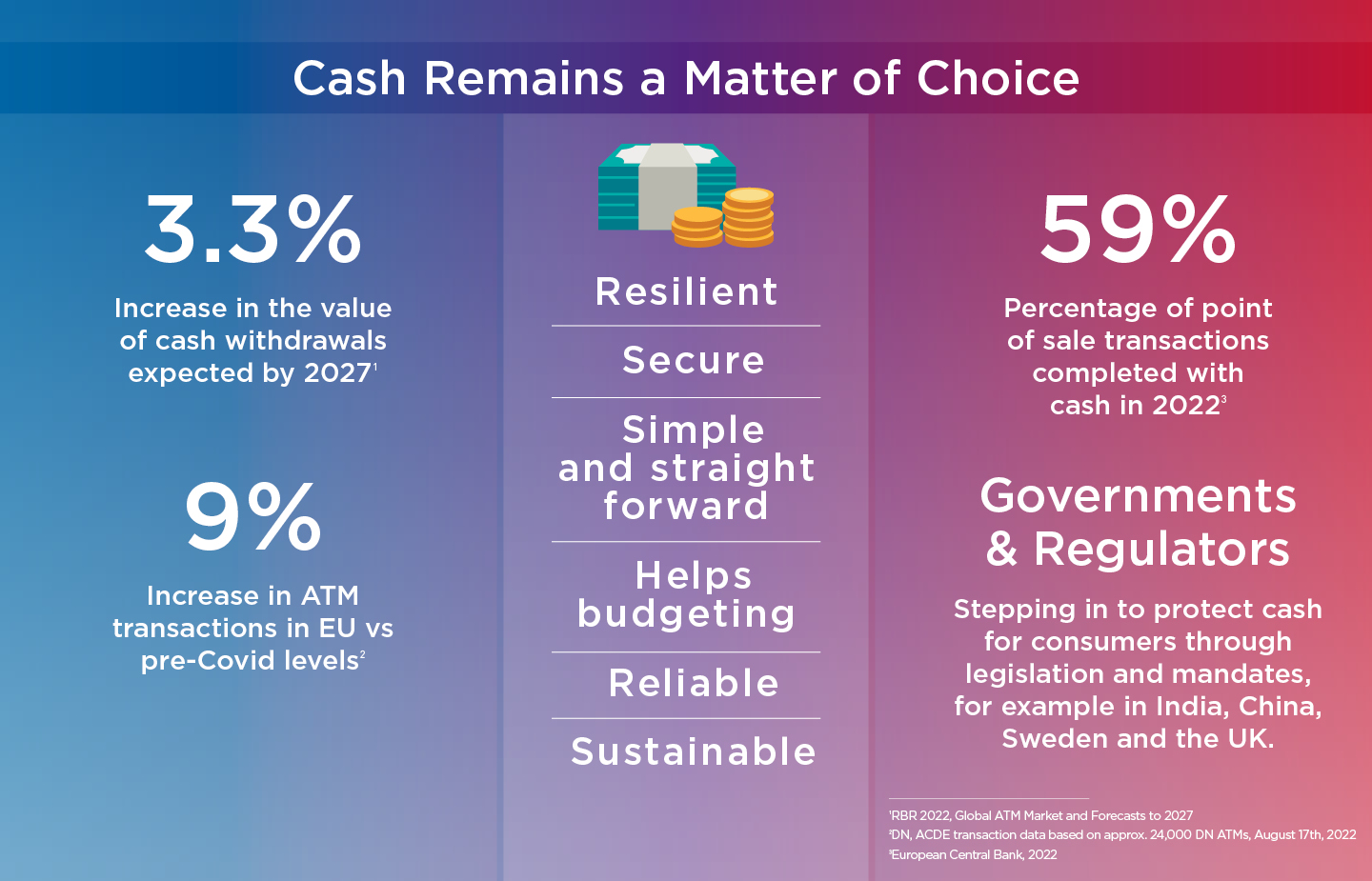

Many things have changed in recent years when it comes to the way we use money and how we pay for things; but one thing remains clear. Cash is still a vital part of the payments mix. Whether used for budgeting, for security, or simply out of choice, providing access to cash is an important societal requirement.

Flexibility, choice and trust should underpin every consumer journey related decision. This is one reason why access to cash continues to be relevant – it is a vital means of payment for many people. Despite calls for society to go cashless, millions of people and businesses rely on cash to function, and it’s often because cash is tangible, easy to access and maintains a high level of trust for many in today’s society.

Customers need to feel safe when using your services and ATM network. Whether it is taking steps to secure your physical security such as integrating inking solutions or implementing advanced software to protect your data, assets and people, security has never been more important.

STEPS TO SECURE CASHMaintaining access to a form of payment in an emergency or unexpected situation is a crucial consideration. Cash proves to be a reliable option when other payment methods could be unavailable, for example during a power outage or cyber attack.

LEARN MOREAs one of the leading financial services organizations in the Czech Republic, balancing customer satisfaction and availability with costs is crucial for CSOB. See how they reduced the cost of cash and increased cash availability to 99.98%.

READ THE CASE STUDYIf cash remains a necessity, then who should take ownership of the cash ecosystem? Central banks, financial institutions, technology providers and retailers all have a part to play.

READ THE BLOG