Banks need to focus on sustainable cost reduction and productivity improvements for long-term value creation. Cash recycling is a great way to achieve this: It can reduce the TCO by up to 20% and cash replenishment efforts by 75%.

But whether you can realize these benefits is dependent on a few factors. Cash recycling is picking up in

more countries. Deposit rates and denomination availability are driving the case for recycling. But how can you get the highest possible return from enabling cash recycling at your ATMs? There are a few key factors in building a sustainable cash recycling strategy. One of the most important is the configuration.

Several factors can influence the optimal configuration, including the volume and mix of transactions, denomination usage, and capacity fill levels. Cash usage can vary significantly from one location to another, rendering a universal configuration ineffective. You may be able to define groups where the same configuration makes sense. But you should track your fleet even after the implementation as usage of a device may change over time. Consequently, configuring your devices should not be a one-off exercise but an ongoing process aimed at achieving optimal outcomes. By doing so, you can maximize the availability of the ATM and minimize the number of CIT visits required.

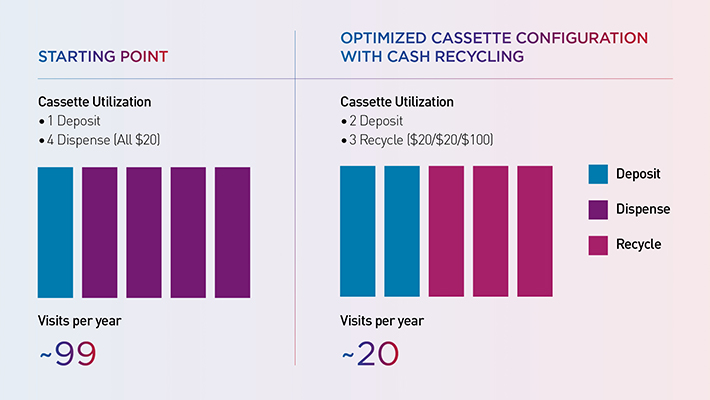

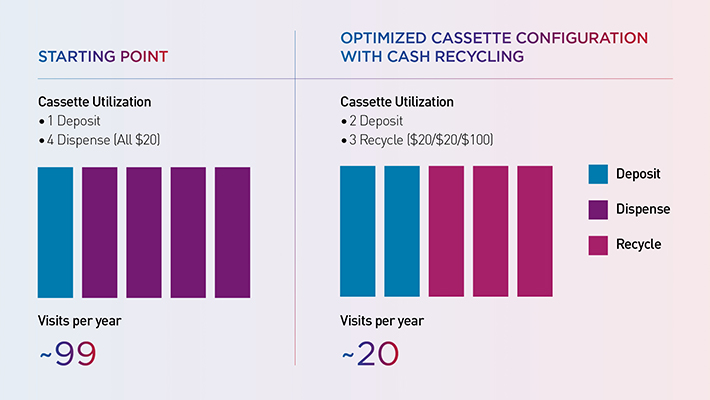

Let’s have a look at an example:

What Happened Here?

What Happened Here?

In this example, the ATM’s deposit cassette is filling up, driving 99 CIT visits per year. To optimize the bank’s cassette configuration to lower cash replenishment costs, three configuration changes were applied:

- The bank added a second deposit cassette for high deposit locations, prolonging the number of CIT visits being driven by the high number of deposits.

- A larger denomination was added to lessen the number of notes being dispensed. Rather than offering only $20 at this ATM, they added a second denomination - $100. So, higher value dispenses – which is a frequent need at this machine - could be done with one note instead of five. This extended the time between the dispense cassettes running empty. And with fewer notes being dispensed, their dispense to deposit ratio became 50%, which makes cash recycling ideal.

- The bank enabled cash recycling. Now users replenish the three cash cassettes with their deposits, rather than the bank paying CIT to refill them. Additionally, this reduces the number of notes going into the all-in cassettes. Thus, extending the CIT intervals for both.

These measures reduced the number of CIT stops by 80%.

How Can You Achieve This?

A data-driven approach can help you find the best configuration for all ATMs in your fleet. Consider which transactions are taking place, when and with what volumes. The easiest way to get this is by harvesting the information from the ATM in regular intervals.

Diebold Nixdorf started the connected device journey more than 10 years ago. The DN Series

® was purposely designed and built as a best-in-class,

IoT-connected device. Once a deployed DN Series device is linked to DN AllConnect

SM Data Engine, data can be analyzed and processed to determine the drivers of the CIT visits. Based on that, we can develop a new model together with your experts to improve the configuration.

A flexible technology platform enables the full power of cash automation and can be adjusted to any new configuration you define based on the data you collect. This includes changing the denomination in the cassettes or switching cassettes entirely.