For the past two years, Diebold Nixdorf has partnered with NielsenIQ to conduct an annual Consumer Banking and Technology survey to understand consumer banking behaviors and attitudes. U.S. respondents were asked questions about finance, their primary financial institution (FI), and their level of interest in various types of banking experiences, both physical and digital.

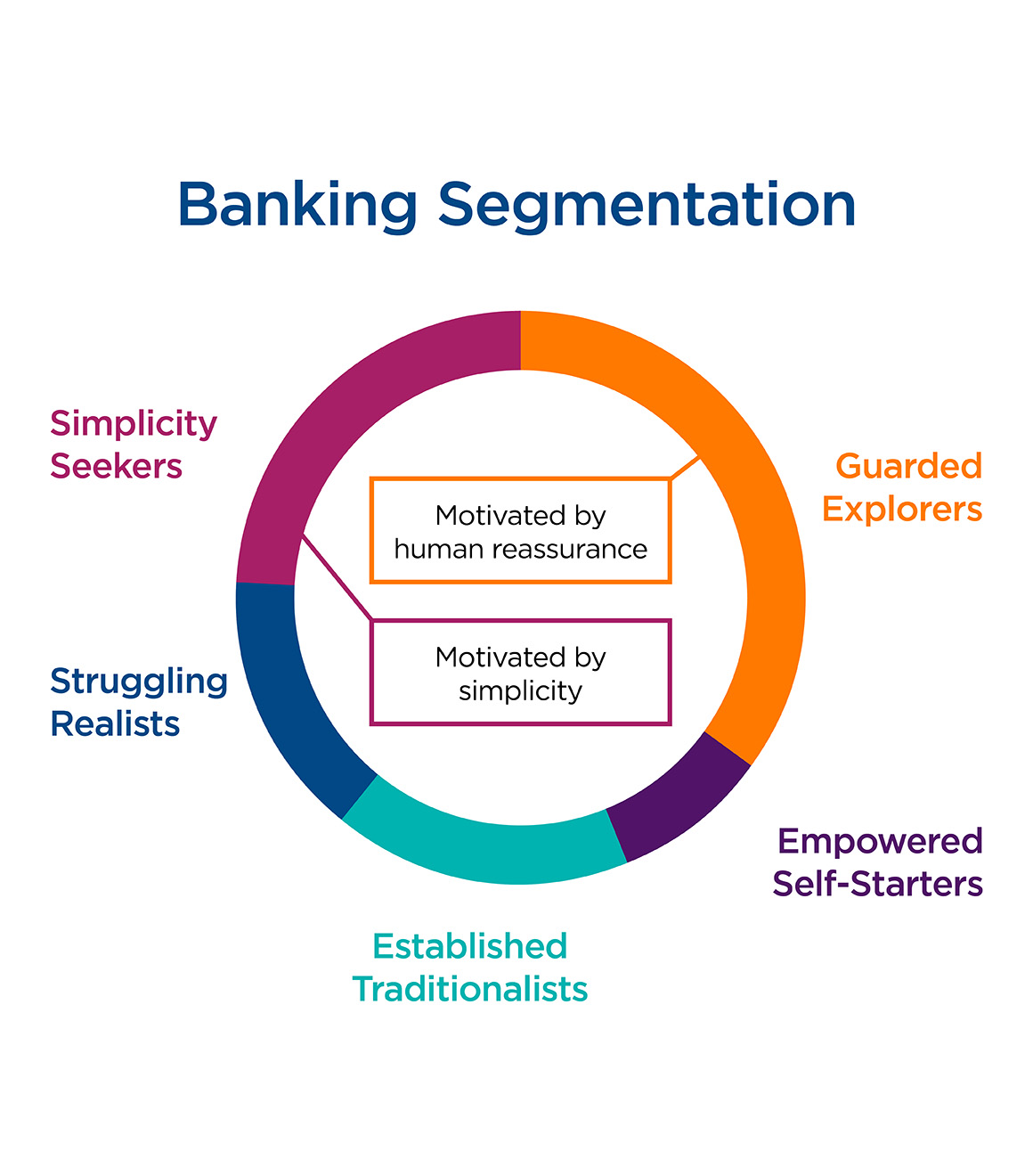

Using advanced analytical methodologies, five distinct consumer segments were identified from the survey results: Simplicity Seekers, Empowered Self-starters, Guarded Explorers, Established Traditionalist and Struggling Realists.

In 2022, the results proved to reflect the uncertain economic environment, with the plurality of consumers falling into the Guarded Explorers segment. This segment, up ten percentage points in share from 2021 when it was second, are predominantly motivated by human reassurance from their bank. The Guarded Explorers increase was primarily driven from younger generations (Gen Z and Millennials), suggesting higher sensitivity to current economic issues among these age groups.

Simplicity Seekers formed the second largest share of consumers. These consumers prefer self-service banking experiences vs. traditional in-person experiences.

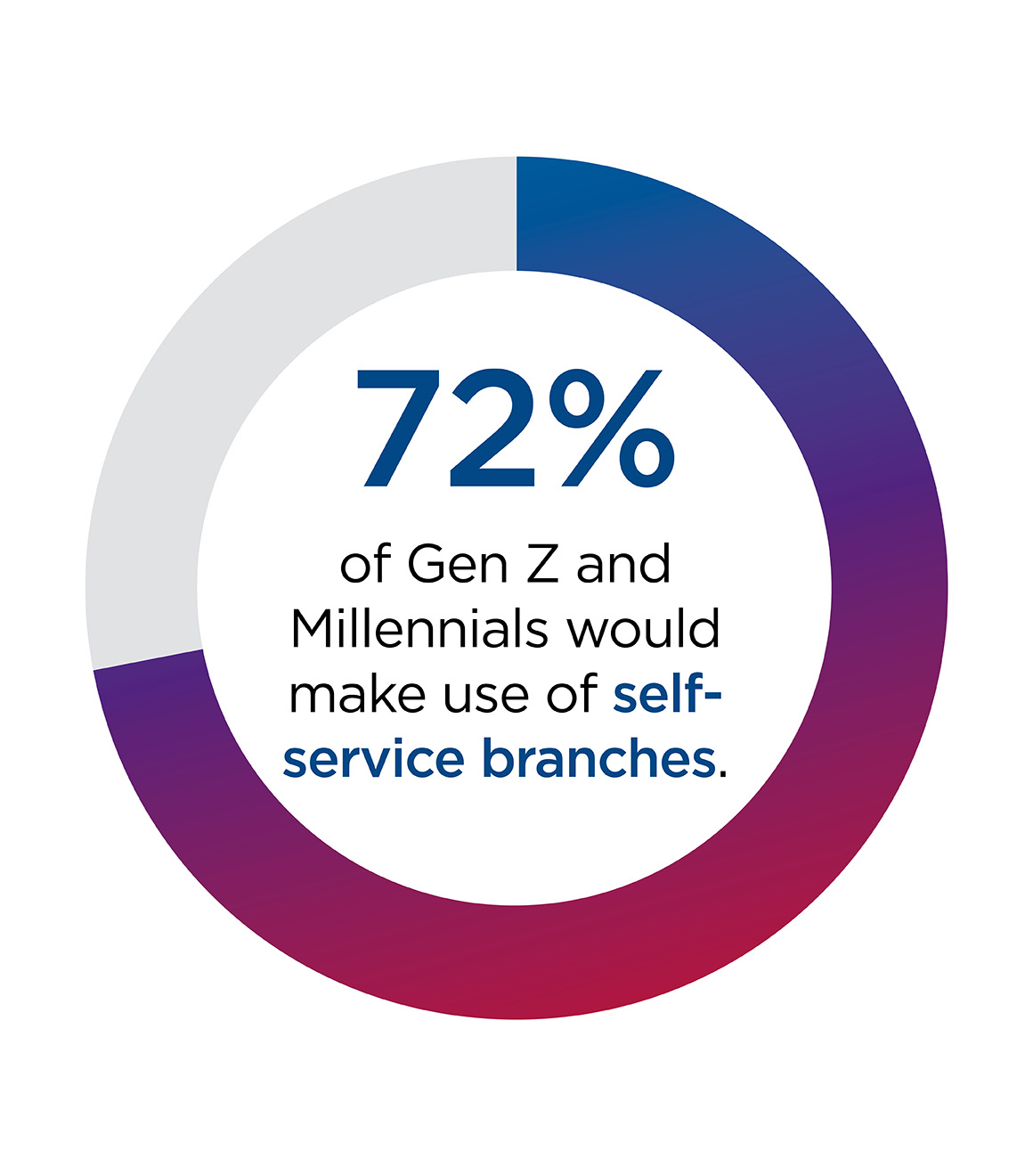

Gen Z and Millennials favor self-service. These age groups gravitate towards self-service branches (i.e., branches with a fully functioning ATM and a banker, but no tellers) over traditional branches with tellers. Bankers at self-service branches would resolve problems and engage with customers to understand their needs.

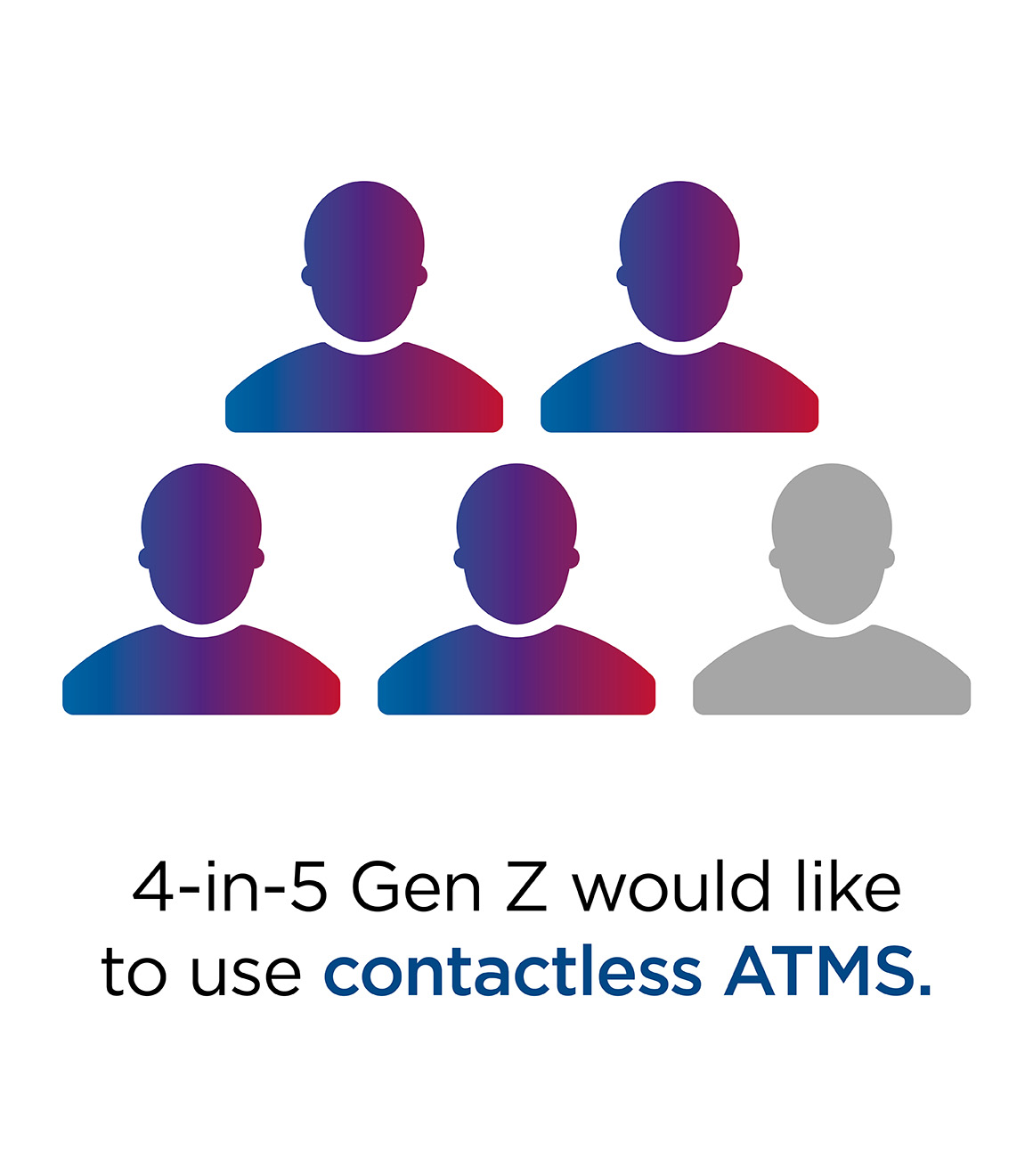

Advanced ATM features and functions are becoming increasingly in-demand. Contactless functionality and mobile app-to-ATM integrations are popular among all age groups, but especially among younger generations, in part driven by the growth of contactless point-of-sale systems and the reliance on mobile apps for banking.

ATM access drives customer acquisition. When asked what criteria one uses when selecting a primary FI, ATM access was the second most selected, ahead of branch access, digital banking and a dozen other elements.

ATMs continue to play an important role in banking. Self-service transactions are trending up. Teller transactions, while on the decline, still make up a significant portion of certain customers’ transactions, providing opportunities for FIs to migrate even more transactions to self-service channels.

Learn more about our Advisory Services and how they can help your organization determine the best path toward effective digitization.