As consumer expectations for self-service and digital-first banking options evolve, financial institutions face mounting pressure to optimize branch operations while adapting to evolving cash usage trends. Contrary to popular narratives, cash usage may be declining, but it is far from dead.

Data from the Federal Reserve

1 and industry studies show that cash usage remains significant for older and low-income consumers, unbanked households and as a contingency payment option. Consumers hold more cash than before the pandemic and rely on its reliability and anonymity

2, reinforcing the need for banks to maintain consistent cash access.

Meanwhile, U.S. branches have declined by 16% over the last decade, pushing more cash transactions to ATMs and self‑service devices. Maintaining consistent cash levels in branches and ATMs ensures that banks can serve these customer segments, meet regulatory fairness obligations and provide resilience in case of digital outages. It also allows banks to capture deposits from small businesses that still rely on cash and avoid losing relationships to competitors who offer convenient deposit endpoints.

Globally, markets such as Latin America, Europe and the Asia-Pacific region have embraced cash recycling — that is, automated cash handling technology — to reduce costs, increase the availability of banknotes, and modernize operations. Yet in the United States, cash recycling adoption remains limited to just 5% of institutions. But with increasing cash deposit volumes

3 and rising cost of cash, an emphasis on branch efficiency, and the need to reallocate staff to higher-value activities, cash recycling offers a scalable solution for forward-thinking banks. This can help cut costs, reduce risks and boost service quality from bank employees.

As digital payments grow, cash recycling can ensure cash remains efficient and relevant in the era of omnichannel banking, especially when deployed as part of a closed cash ecosystem that automates and reuses cash internally, minimizing manual handling and armored transport.

Latin America, Europe and Japan Lead the Way

If U.S. banks are to expand their adoption of cash recycling, there are compelling case studies to pull from all across the globe. In Latin America, Brazil is a standout adopter of cash recycling technology. While overall cash use has declined, nearly 70% of Brazilians still rely on cash for everyday transactions, according to the Central Bank of Brazil. The reliance on cash is why bank networks in the region began rolling out cash recycling technology as early as 2014

4.

While Brazil is a more recent example of cash recycler success, there are other regions from which U.S. financial institutions can draw inspiration. For decades, Europe and the Asia-Pacific region have been global frontrunners in adopting and scaling cash recycling technology, and that is largely due to distinct market dynamics, cultural preferences, and strategic priorities in banking operations.

Cash recyclers in Europe gained traction in the late 1990s and early 2000s as Germany, Scandinavia and the U.K. began to adopt the machines. At the time, European banks faced pressure to reduce branch operating costs as deregulation and the introduction of the euro led to a consolidation of bank networks and the rethinking of teller workflows.

European financial institutions embraced cash recyclers to streamline operations, improve branch productivity and reduce cash-in-transit, or CIT, costs.

Japan saw some of the first cash recyclers deployed in the late 1980s to early 1990s, thanks to high cash use and consumer demand for self-service banking options. By the early 2000s, cash recycling ATMs and teller units were widely available from Japanese banks, offering 24/7 self-service deposit and withdrawal functionality. Other markets, such as South Korea, Taiwan, and Singapore, quickly followed suit. While consumers in these countries typically embrace new technology, cash use remains a prominent part of the Asia-Pacific culture.

Why Cash Recycling Makes Sense in the U.S.

While other geographical regions offer U.S. financial institutions a valuable blueprint for expanding cash recycling, there are important contextual differences.

In the U.S., the role and structure of bank branches have been in constant flux, particularly in terms of customer service models and technology integration. FDIC

5 data shows a 16% decline in branch locations between 2014 and 2024, which is fueled by digital adoption, cost pressures, and evolving consumer behavior.

That said, the cash landscape in the U.S. is changing despite the rise of digital banking and payments. While ATM withdrawals are trending down, cash deposits remain steady, which will mean a shift in new approaches to cash handling. In 2024, the Federal Reserve’s Cash Services received 29.2 billion notes

6 in deposits from banks, only slightly below 2023 levels. This nearly‑30‑billion‑note volume underscores that banks continue to collect and return significant amounts of cash.

Datos Insights’ 2025 Deposit Automation and Recycling Report found that deposit transactions in the US have been increasing rapidly in recent years

7, driven by a larger number of installed machines and growing customer familiarity with self-service deposits. The number of banknote deposits has increased more rapidly than checks in recent years (and accounted for 70% of all deposits), signaling continuing demand for deposit services.

In general, cash remains vital for unbanked and underbanked populations, as well as in large metropolitan areas where cash bans at retailers are under scrutiny. Consumer trust in and reliance on cash remains high, as over 90% of people have no plans to stop using it, according to a Federal Reserve study

8 about payment choice.

Operational Efficiency and Cost Optimization

Cash recycling represents an opportunity for banks, as many reconsider the future of branch operations and self-service options. Internal data from Diebold Nixdorf suggests cash handling can represent up to 50% of an ATM’s total cost of ownership; recyclers can significantly reduce this burden. Potential cost reductions include a 20% lower total cost of ownership, up to 75% reduction in replenishment efforts, and up to 80% fewer CIT visits annually.

Branch personnel also benefit from cash recyclers, as those

machines automate high-frequency transactions like deposits and withdrawals. This enables branch staff to assist customers with higher-value products such as loans.

Cash recycling can also support sustainability goals by reducing CIT frequency, fuel use, and emissions. Self-service recyclers improve resilience in areas facing severe weather, maintaining service availability even in challenging conditions.

A path forward for U.S. banks

While every region has its own challenges, the fundamentals for the U.S. market are clear. As cash handling needs shift and legacy systems age, financial institutions need practical solutions that can scale.

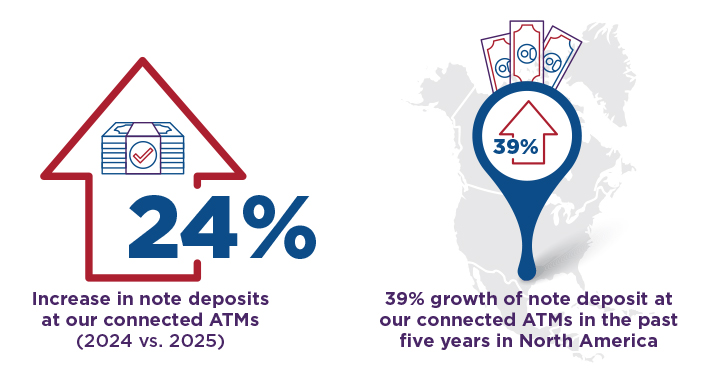

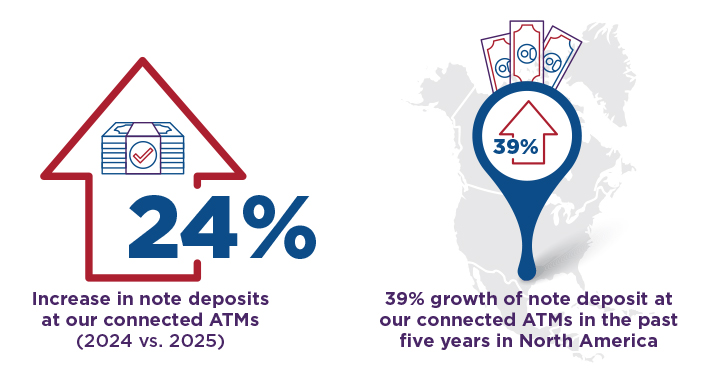

At Diebold Nixdorf, we have seen a 24% increase in note deposits at our connected ATMs year over year (2025 versus 2024), with note deposits at our connected ATMs growing 39% the past five years in the North American market.

Meanwhile, data from Datos Insights

9 shows that all North American note deposits, by transaction and value, have increased by 12% since 2019.

As it stands now, outside of the largest banks, U.S. networks will need to enhance their infrastructure before they can fully move to cash recycling. However, regional and community banks should note that they can take steps now to fine-tune their fleets and start seeing some of the benefits of this technology as they wait for their networks to fully support cash recycling. By prioritizing best practices in transaction migration and cassette optimization, smaller banks can see immediate returns in a deposit automation environment.

Cash recycling offers U.S. banks a way to manage the realities of today’s cash environment while keeping consumer access strong, costs down and infrastructure ready for what’s next in the coming years. Even small enhancements could unlock savings and service improvements. Over time, wider recycling could help U.S. banks reduce branch costs, mitigate cash-in-transit risks, and maintain omnichannel access to cash.

In a changing payments landscape, cash recycling offers a practical, proven strategy. By bringing lessons from Europe, Asia and Latin America to the U.S. market, banks can keep cash both efficient and relevant, cutting costs and boosting service at the same time.

Originally Published in

ABA Banking Journal.