The face of banking has changed dramatically over the past few years. Technology has been at the core of this transformation, enabling consumers to manage their financials in an increasingly self-determined way, and putting financial institutions’ (FIs) traditional engagement models under pressure. “Consumers are going digital” is the phrase we hear so often—but is it really as simple as that?

The bottom line is that consumers are diverse, and we can’t just call them all “Digital Natives” and decree that all of banking should fit on a smartphone´s screen. For example, you may be surprised to learn that 69% of individuals who fall into the Baby Boomer generation like how technology helps them to save time—and you may be even more surprised to discover that more than 60% of GenZ and Millennial banking consumers don’t think that technology can replace real human interactions. To understand what´s really driving consumer choices, NielsenIQ and Diebold Nixdorf set out to capture the motivations behind the ways people bank today and how they want to leverage banking technology.

Voices from 12,000 consumers across 11 countries

We surveyed 12,000 consumers across 11 countries in March, 2021. Through this extensive, individualized data NielsenIQ uncovered unique consumer segmentation groups. The team applied latent class modeling to expand beyond typical variables and include individual attitudes and life values.

“Companies used to just look at gender and age, maybe financial state, and make their assumptions on what services would be most suitable for a customer. That is not enough to speak the same language. Think of their life stage, their beliefs and values, their habits and attitudes; these do not adhere strictly to certain ages.”

— Özlem Yilmaz-Daniel, NielsenIQ, Customer Insights Team Leader

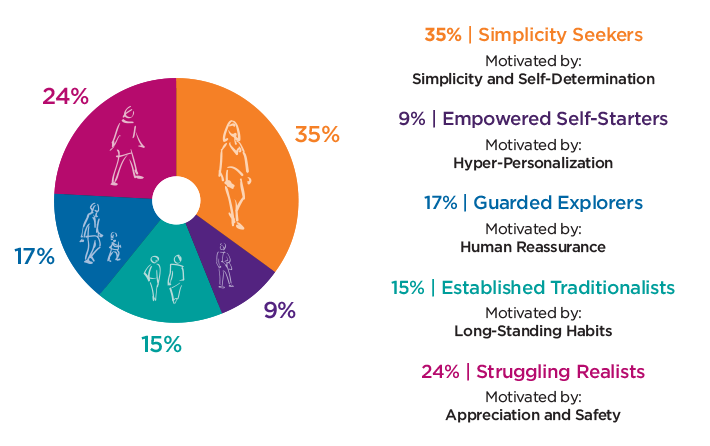

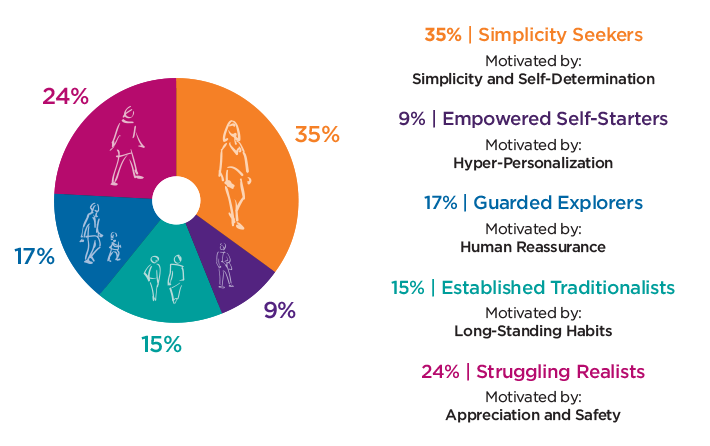

The Tech Types: Five financial consumer segments with distinct motivations

FIs need to dig deeper if they want to understand what makes their customers tick. Generalizations based on a single factor (age, for example) can actually be a hindrance when identifying useful client segmentations. We all have inward motivations (often unconscious) that determine whether we look back at an experience with satisfaction. These motivations must be met appropriately, at the right time, with the right mix of technology and human interaction, to ensure delivering consumer experiences that matter.

The analysis discovered five consumer segments with distinct motivations that influence their banking habits. What´s more, those motivations also influence technology preferences and determine what kind of solutions are best suited to create a positive banking experience. Emphasizing the impact on technology preferences, we refer to these consumer segments as “Tech Types.”

Demographic splits are insufficient to design the optimum engagement experience

Demographic splits are insufficient to design the optimum engagement experience

A good example of the nuances we discovered can be found in a comparison between “Simplicity Seekers” and “Guarded Explorers”: While they’re closest in average age (35 versus 37 years), Simplicity Seekers are a low-maintenance segment who approach banking in a highly self-determined way. They prefer self-service and digital interactions and manage risk by avoiding unnecessary complexity. This Tech Type prefers FIs that offer standardized, simple products, ease of use in everyday interactions, and one-click experiences.

In contrast to the Simplicity Seekers, Guarded Explorers do not shy away from taking risks in life. They have a spontaneous and flexible mindset that conflicts with the traditional, planned world of banking. This conflict creates insecurity, resulting in the need to seek human reassurance—making it mandatory for FIs to offer personal relationships. Guarded Explorers turn to technology that builds bridges to humans or provides a more human-like client interaction, such as voice assistance.

Conclusion

Designing and delivering the optimal engagement experience has become more complex than ever. Consumer demands have not simply “gone digital’; choice is still paramount. Our research found that 71% of consumers are leveraging all main banking touchpoints: branches, online or mobile options, and ATMs or banking kiosks. And consumers who leveraged various touchpoints across their banking journeys were more likely to claim that they felt appreciated by their financial provider, compared to consumers who conducted their banking journey digitally.

Fortunately, FIs do not have to manage the full complexity on their own. When it comes to delivering the ideal client experience through self-service technology, cooperating with operational partners like Diebold Nixdorf can increase agility and accelerate speed to market with consumer-focused innovations that drive growth.