The modern banking landscape is all about journeys. At the forefront is the delivery of the connected, always-on journeys today’s consumers have come to expect. Equally important are operational journeys―those that enable the financial institution to achieve new levels of automation, efficiency, service and performance. Getting these journeys aligned is essential to financial institutions’ (FIs) success, as each is unique to the FI and has a direct impact on the other. The most valuable technology partners are those that can support and give the capacity to deliver these journeys without friction.

Where does the friction occur in banking? Wherever a financial institution’s staff or customers are unable to drive their desired journeys. There could be friction at the ATM for a customer who can’t access desired denominations or accounts, forcing him into the teller channel. Or a customer who doesn’t have the flexibility to perform a self-service transaction because of a limit or business rule. Or a small business customer who must address her cash needs over the counter, rather than using a channel that’s more convenient for her. For a financial institution that can’t easily benefit from cash recycling because its switch/transaction processor doesn’t support it. Or any number of other instances in which channel, interface, process, or data present a barrier.

The Right Approach to Modernizing Channels

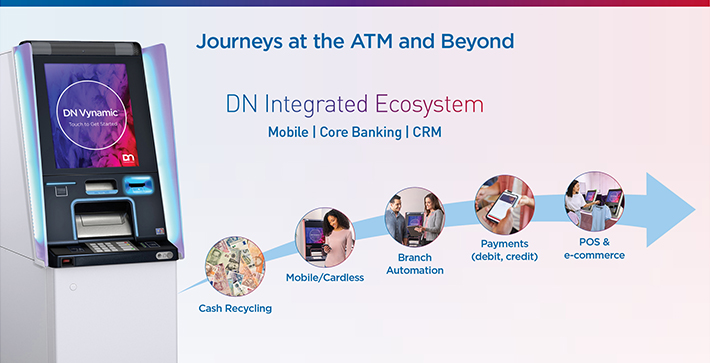

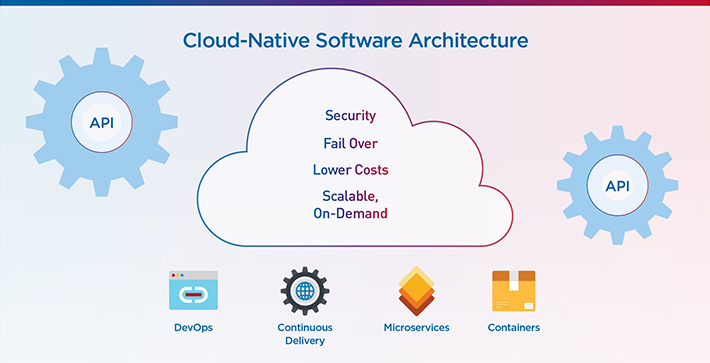

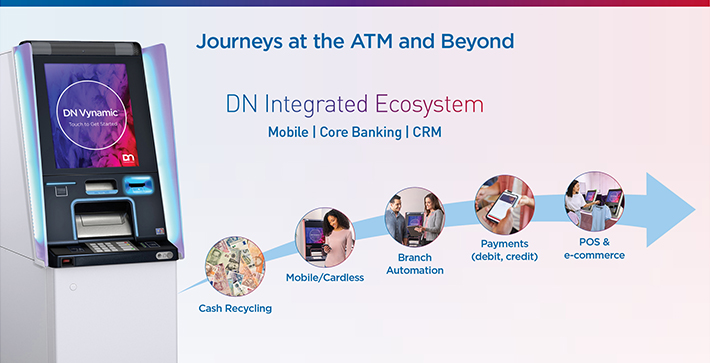

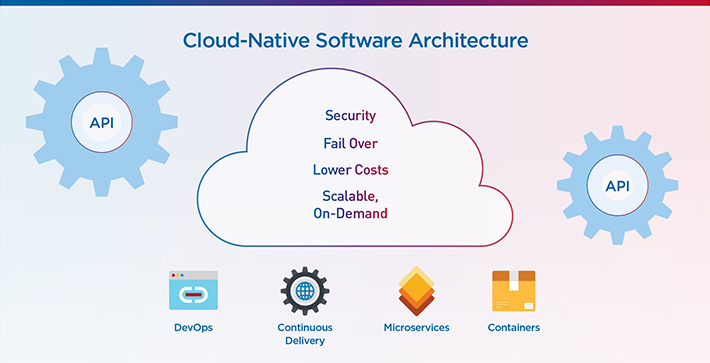

Removing these barriers creates banking journeys that are Built for More: More integration and personalization. More efficiency and availability. More security. And more ready for the future. But until now, building for more involved the use of antiquated technologies that were designed for banking of the 1970s or 80s. For example, if a financial institution wanted to migrate transactions from the teller to self-service, while also opening the ATM for alternative identification or mobile integration, the existing boundaries in the proprietary, locked-down system weren’t designed with this in mind. Fortunately, today’s modern architecture allows FIs to bypass the barriers of legacy infrastructure and enable access to state-of-the-art technology that fast-track innovation and reduce the cost of ownership— all without compromising on compliance, security, reliability, or resilience. Utilizing an API connected ecosystem and cloud-native low-code architecture, FIs can disengage from the financial and operational burden of managing legacy systems, or free themselves from the limitations of existing service providers. Organizations can become more consumer-centric and deliver a wider range of transactions and functionality across ATM, POS, and mobile as well as ecommerce channels.

The Bridge to Today’s Financial Ecosystem

The Bridge to Today’s Financial Ecosystem

Modernizing channels is just the beginning. To truly eliminate friction, financial institutions must think beyond channels to create dynamic ecosystems using APIs, shared services, and cloud technology to create an open, standards-based platform. This modern-day architecture is the bridge to creating and connecting these ecosystems. It’s also the bridge that expands the ecosystem to give financial institutions a better competitive position against the players that are chipping away at their fundamental existence.

We now know that the bank of the future does not necessarily have to be a bank. Today, financial institutions are battling for wallet and mindshare against the likes of fintechs like Monzo, Digit, N26, Nutmeg or Revolut that have unbundled financial services, breaking apart products that have long been delivered by financial institutions. They’re also preparing to go head-to-head against digital tech giants like FAAMG―Facebook, Amazon, Apple, Microsoft and Google―that threaten to build their own nontraditional banking models. With these competitors seemingly building new financial offerings overnight, high-performing, scalable and adaptable software that allows financial institutions to quickly innovate and evolve is more important than ever. Especially consumer-facing technologies – as they are designed to be more mobile-like or mobile-driven, because digital-first is what today’s consumers demand.

Transforming the Financial Institution, Right Off the Shelf

At their very essence, all financial institutions have something in common: They want to provide their customers with a high quality of service while optimizing the delivery cost of that service. But the way they transform to achieve these goals varies greatly. For one financial institution, transformation could mean moving a transaction set to a different channel. Another could aspire to create a consistent user experience across channels. For another, it could mean completely removing cash handling in the branch. As financial institutions strive to evolve their infrastructure and systems to support improved journeys for all endpoints, Diebold Nixdorf has the solutions to tie ATM and other channels together and integrate the front end, back office, and core banking, without limitations. Vynamic® Payments open and API driven services allows the mobile channel to be integrated to consumer banking apps to execute cardless transactions and leverage its step up authorization while supporting cardless staff deposits for merchants. Additionally, it enables the integration with teller applications to provide assisted services while using the ATM channel to manage all cash handling in the branch.

Is your organization ready to modernize your banking ecosystem?

Let’s discuss how we can help you develop the plan.