When banks modernize their ATM networks, they’re not just investing in machines - they’re shaping the way consumers experience trust, convenience, and access to cash. The DN Series® 300 & 350, powered by the advanced DM7V dispensing module, redefines what it means to operate a future-ready cash dispenser platform.

It’s a shift from fragmented, legacy technology to a unified, intelligent infrastructure that drives operational excellence and brand confidence. Every device shares the same DNA—from processors to cassettes—making it easier to train staff, manage inventories, and deploy updates globally. The result is a self-service ecosystem that works harder and smarter: higher uptime, lower costs, and a consistent user experience across every touchpoint.

A Unified Architecture That Simplifies Everything

At the center of this transformation is the DM7V dispensing module. By standardizing on the vertical “V-cassette” architecture, banks can use the same cassette type across their fleet, simplifying cash logistics and maintenance. Whether it’s a high-traffic city branch or a remote rural deployment, the same system adapts to local demand patterns. Fewer cassette types mean faster replenishment, fewer errors, and a smoother cash cycle from branch to cash-in-transit (CIT) operations.

The V-Cassette is not just a container—it’s an intelligent component within the DN Series ecosystem. Its vertical orientation and modular design optimize space, ergonomics, reliability and add flexibility with the dual cassette approach.

In the DM7V, these cassettes handle cash dispensing and storage, while in recycling devices like the RM4V, they enable both deposit and withdrawal operations. Despite these differences in functionality, both versions share identical physical interfaces, enabling true interoperability. Each V-Cassette variant supports Trusted Device Communication (TDC) for encrypted, secure data exchange, is ink-ready for physical protection, and can be ordered in lockable or convenience versions to meet regional security standards. This flexible approach to cassette functionality ensures that Diebold Nixdorf’s technology adapts to any environment.

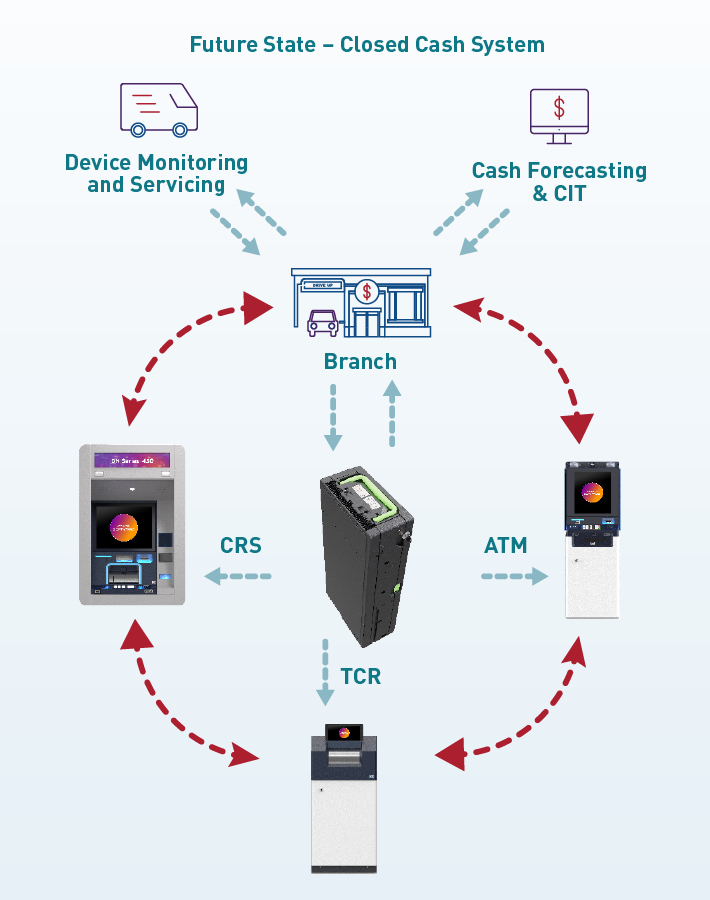

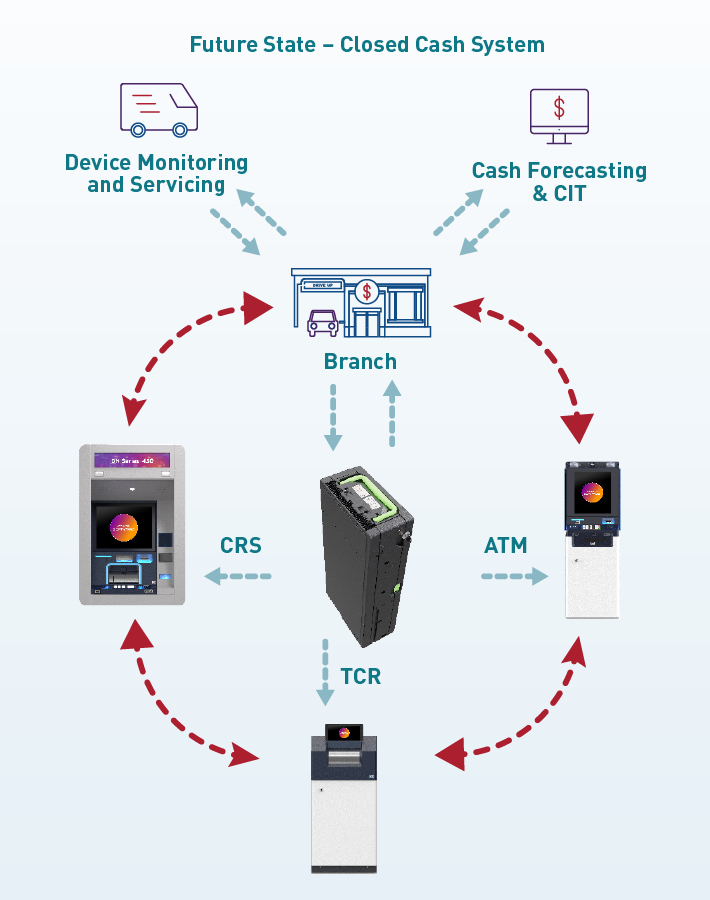

One Platform for a Closed Branch Cash Cycle

A modern branch is no longer defined by its counters or cash drawers. It is defined by how seamlessly it connects teller systems, self-service devices, and back-office operations. This is the essence of a closed branch cash cycle: a continuous, intelligent flow of cash within the branch, powered by shared technology and data-driven automation.

In this model, cash recycling ATMs, Teller Cash Recyclers (TCRs), and cash dispensers all work as one ecosystem. Each device interacts with the same type of “V-Cassettes”, allowing deposited cash to be reused within the same location or region. That means the money a customer deposits at a teller window in the morning can be dispensed by an ATM that evening, without manual counting, sorting, or transportation.

The outcome is a branch that operates more efficiently, sustainably, and profitably. Banks experience fewer CIT visits, greater transparency across all cash points, and better liquidity management while customers enjoy uninterrupted access to cash and shorter wait times.

At the core of this transformation is Diebold Nixdorf’s DN Series

® 300 &

350, powered by the DM7V dispensing module and a common V-Cassette platform that unifies the cash cycle from end to end.

Inside the Closed Branch Cash Cycle

A

closed cash cycle works like a living system, balancing cash positions automatically across all touchpoints.

Here’s how it functions in practice:

1. Deposit at the Teller or Recycler. Cash deposited into a Teller Cash Recycler (TCR) or a DN Series recycling ATM is validated and stored in a secure V-Cassette.

2. Data-Driven Forecasting. Through DN AllConnect® Data Engine, every cassette reports real-time capacity, denomination mix, and condition, enabling automated cash forecasting.

3. Cross-Use Between Devices. When an ATM’s dispenser cassettes require replenishment, the same cassettes from the recycler—already containing validated cash—can be exchanged directly.

4. Reduced CIT Intervention. Because cash remains within the branch ecosystem, armored transport visits drop dramatically, saving time, emissions, and cost.

5. Full Transparency. Integrated monitoring provides a complete overview of the cash cycle—helping banks fine-tune liquidity management and improve forecasting accuracy.

The benefits are significant:

- Up to 30–40% fewer CIT visits.

- Better cash usability and faster turnover.

- Higher customer satisfaction through always-available service.

This standardization gives financial institutions unprecedented operational flexibility:

- Simplified logistics – the same cassettes can be moved between devices or locations.

- Streamlined service – fewer spare parts, easier staff training, and faster replenishment.

- Predictive management – via DN AllConnect® Services, which monitors cassette levels and usage trends in real time.

By connecting the DM7V-based cash dispensers with RM4V-based recyclers through shared technology, the DN Series enables banks to run true closed cash cycles—where every device contributes to a self-sustaining ecosystem.

Transform with Confidence

With interchangeable V-Cassette technology, modular design, and predictive digital services, Diebold Nixdorf enables banks to operate with one consistent platform across every branch model and market. Whether in a fully automated branch, a self-service zone, or a rural micro-location. The DN Series delivers what every financial institution needs most: confidence in every transaction, connection, and change.

Interested in exploring more about the next generation of self-service banking?

Start here.