Around the world, and across the Middle East where I lead regional efforts, financial institutions are at various stages of automating their cash journeys. Despite the rise in digital payments, cash remains vital, and in many cases, cash deposits are increasing.

The advantages of this service are multilayered, benefitting key areas of your cash management strategy:

Operational Efficiency and Total Cost of Ownership (TCO)

Cash recycling is a huge enabler to achieve new operational efficiencies. It reduces cash replenishment, cash movement and CIT stops, decreasing the number of out-of-service events and the accompanying frustration caused by the need for sweeps or replenishments of the ATM.

With DN Series™ Cash Recycling ATMs, you can lower your TCO by ~41-50% through fewer CIT stops, reduction of on-site intervention time and less cash moving through the branch.

Continuity and Availability

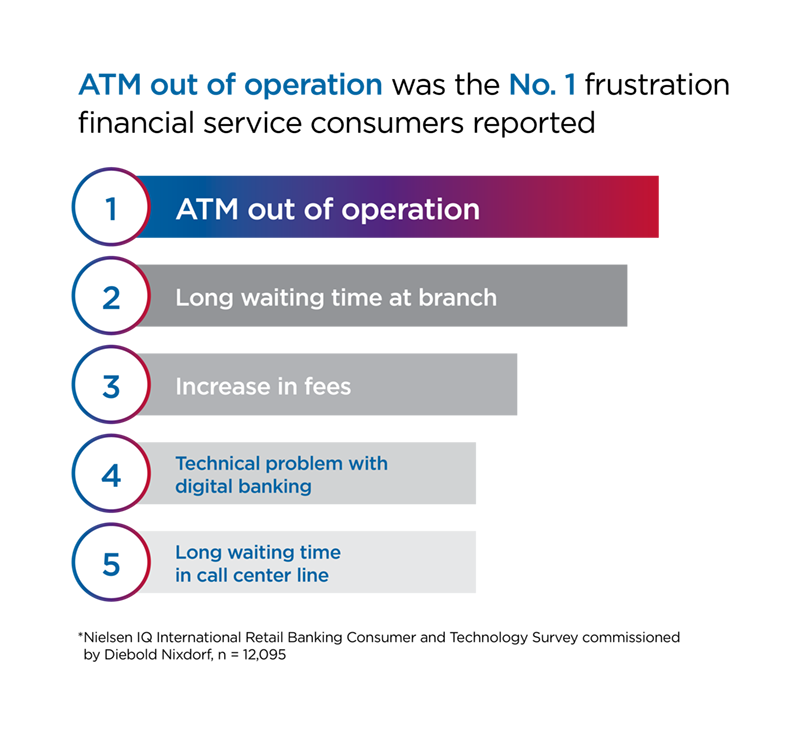

Convenient access to cash is critical to consumers and the primary reason people use ATMs. How many hours is your ATM fleet out of service because of cash handling required during CIT visits? In a Diebold Nixdorf commissioned report from Nielsen IQ, “ATM out of operation” was the number one frustration reported by financial service consumers reported. Self-service cash recycling makes your services available to consumers even when your branch is closed, so you’re improving your consumers’ self-service experiences and at the same time improving conditions for your employees. Implementing process-automation via self-service cash recycling systems that can securely and accurately accept, store and recirculate cash can mean fewer resources devoted to ATM cash supply, higher availability and better services.

Flexibility and Speed

The self-service channel is becoming more important, due to increasing consumer demand, the desire for social distancing and the need to optimize operational efficiency. Automating the cash journey wherever possible becomes absolutely critical. This is where smart self-service cash recycling solutions can help—cash recycling allows your consumers to deposit cash when it is convenient for them, regardless of your branch’s operating hours. Migrating more transactions to the self-service channel helps consumers avoid long lines at the teller.

Cash recycling offers an especially exciting new opportunity for your small- and medium-business (SMB) clients. They can deposit larger bundles more easily through self-service, simultaneously providing cash that can be immediately recirculated through the ATM to use for cash-out transactions. In most cases, SMBs account for about 70% of all cash-in transactions within the branch and require physical activity, for both the SMB and the FI. The more the SMB segment is migrated to self-service, the more it helps reduce cash-related costs by creating a closed-loop recycling environment that automatically moves money through the system.

Are You Taking Full Advantage of Cost Optimization Capabilities Within Your Self-Service Fleet?

Cash-recycling technology, previously perceived by many FIs to be too expensive or complex to implement, is proving to be a viable option for banks around the world. Recycling ATMs have been shown to reduce CIT costs and many banks now rank recycling as a basic functional requirement when selecting new deposit terminals. Even with a ratio of 70:30 of deposits to withdrawals (and vice-versa 30:70) cash recycling can be a useful tool for a branch to improve operational efficiency.

Whatever your next step is on the cash automation journey, you can rely on Diebold Nixdorf’s future-ready ATMs. With 20 years of experience in designing cash recycling technology, DN Series recycling ATMs are designed to meet today’s needs and tomorrow’s vision.

Whether you’ve been using cash recycling for some time and have already seen the benefits and want to know more, or you haven’t yet taken the necessary steps to benefit from it, check out our latest regional guide with real-world examples that explore how you can take full advantage of cost optimization capabilities within your self-service fleet.

Sources:

1 https://datos-insights.com/resources/newsroom/press-releases/