IT outsourcing has started more than 20 years ago. Manufacturing companies started to outsource their IT processes, data centers and infrastructure to global service providers to reduce their cost and focus on their core business. IT managers had to learn how to manage business outcomes and service levels as delivered by a service provider rather than by their own teams. Suddenly the value to the business was measured in terms of capacity release and as a KPI for the responsible manager than the legacy team dynamic (managing direct reports, IT projects, development cycles, etc.).

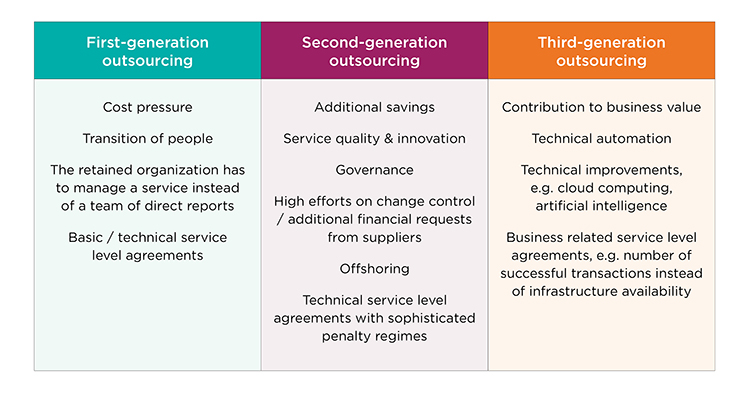

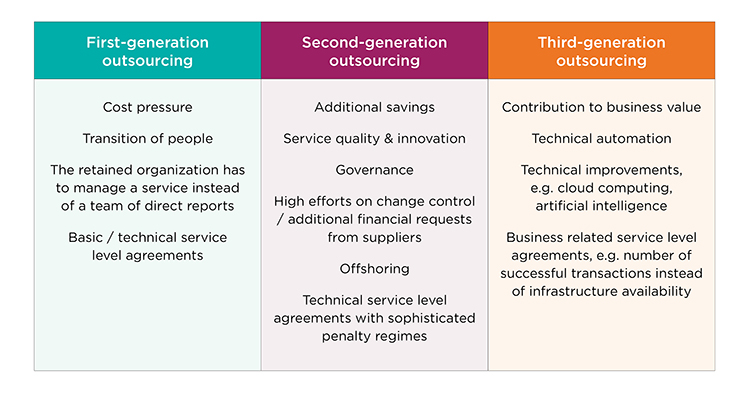

The evolution and maturity of outsourcing has come of age. First generation outsourcing with a major focus on cost reduction set the stage for changing the operating cost management model. However, over time the offerings have become more diverse, more integrated and more comprehensive. As a result, customers and suppliers have learned that the evolution to the third generation outsourcing model of today delivers business value first:

Challenges in the self-service channel

Challenges in the self-service channel

Before looking at potential learnings from outsourcing experiences in other industries, let's take a moment to understand the driving forces behind the rationale to outsource the self-service channel:

The self-service channel has been a niche within the IT of a Financial Institution (FI). The conundrum; too steeped in proprietary technology and legacy systems to make handover simple – it was perceived as simply too ‘exotic’ to be taken into account when classic IT services like datacenters, LAN/WAN connections and desktop computing have been outsourced. On the flipside of the argument, the self-service channel remains strategically important enough to matter to the FI and, more important, for optimizing consumer experience and satisfaction.

Related to the self-service channel, FIs predominantly focus on the following key themes:

Cost reduction – be that in the form of headcount reduction, expense or capital reduction or simply freeing up operational time managing the channel

Branch transformation – introduction of new branch formats and technology to address changing market requirements, consumer behaviors and service models

Increasing regulation and compliance – data and transactional security, technical compliance with Windows 10 etc.

Transaction processing and terminal driving where the integration of new functionalities like cash recycling and more innovative topics like authentication on a mobile device is very expensive and time consuming

”Do it myself” or “Do it on my behalf”

Today, many banks have internal organizations to define requirements for self-service journeys that span hardware provisioning and installation, development and maintenance of ATM Software, monitoring and management of security, cash and availability of the self-service devices themselves. Third parties provide commoditized services like CIT activities (cash transportation and cash processing) and technical break and fix services (Second Line Maintenance services).

It is complex, time-consuming and costly. It often results in the FI asking themselves if it’s worth the investment. It is…especially when the FI reviews some key considerations for how they envision managing a self-service channel of the future:

What are the core value-add activities I want my branch employees to spend time on?

Do I really need to be an expert for ATM compliance and regulation?

Can I benefit from freeing up talent and capacity by shifting management of ATM software and infrastructure to an external partner?

Is cash management really a core competence for a bank?

How do I create the most value for my organization?

The continuum of where an FI sees their channel (and the potential for outsourcing a portion or all of it) doesn’t have to be a binary decision. A full outsourcing of the self-service channel as traditional ATM outsourcing or in pre-defined, bundled packages and solutions are equally viable variations of an alternative operating model. Selective outsourcing with a la carte or pre-bundled packages of operational management capabilities, also commonly known as managed services may be the right first step. With services like cash management, security and availability management, standardized ATM application services, marketing and personalization and transaction processing management can ease the burden quickly and with beneficial cost-justification.

To identify the level of outsourcing your FI is ready for, seek some advice from a trusted advisor and expert in the field. Our team at Diebold Nixdorf can help you navigate the following topics that you should consider:

1. Define your outsourcing strategy

2. Focus on people and processes that create business value

3. Use state of the art methods and tools to support frictionless consumer journeys

4. Enable business growth and customer satisfaction

5. Manage your digital strategy (including the self-service channel) with a business partner

We at Diebold Nixdorf have successfully helped clients to navigate this journey and are happy to share our experiences to support the right level of outsourcing in your bank. From maintenance operations to business solutions to data-driven insights,

DN AllConnect Services Self-Service Fleet ManagementSM delivers the expertise and innovation to help you thrive by identifying today’s efficiencies and tomorrow's opportunities.

Wherever you are on your journey towards ATM outsourcing, we can help.

Contact us today to get started.