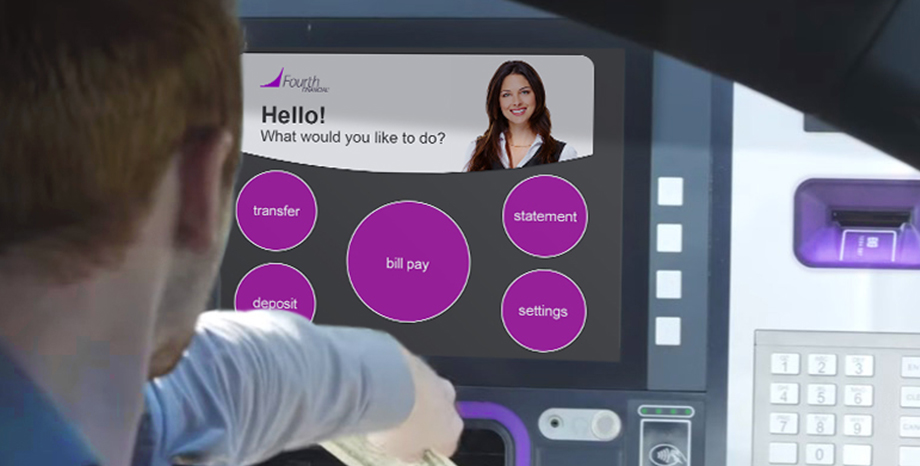

Modern ATMs are capable of so much more than simple “cash and dash.” Sitting at the intersection of consumers’ physical and digital financial lives, the self-service channel can play a pivotal role in helping connect more deeply with consumers.

Allow the ATM channel to integrate with the core banking system for expanded functionality, including on-us transaction processing, assisted support and cardless authentication, delivering true end-to-end customer journeys.

WATCH VIDEO

Enhance your customers’ experience by handling their ATM transaction disputes and questions quickly and accurately.

Consumer defined ATM preferences allow for a more efficient and faster transaction experience.

Your ATMs can tap into the power of the core, to authorize and process on-us credit and debit transactions that are typically handled by a teller.

Give consumers the ability to cash checks and access the deposits in real-time. Cash and check deposits can even be split among multiple accounts during a single transaction.

Empower consumers to pay their bills by transferring funds at the ATM, rather than requiring them to deposit cash into the ATM and initiate an online banking session.

Offer greater flexibility. Consumers and businesses can use their mobile banking app to schedule bank transactions (withdrawals and deposits) for themselves or someone else to be activated at one of your terminals.

Provide the ability to offer add-on innovation that can assist consumers at the self-service device to complete the desired transactions when necessary. By providing a video on-demand, the customer service representative can provide:

Handle more exceptions through self-service, reducing need for teller line availability.

Vynamic® Transaction Middleware is our transaction processing platform based on cloud-native, micro-service architecture. Powering several Vynamic Software products, including Vynamic Transaction Automation, Vynamic Acquiring and Vynamic Issuing, and enables new functionality utilizing low-code technology, that is easily distributed and scaled.

Learn More