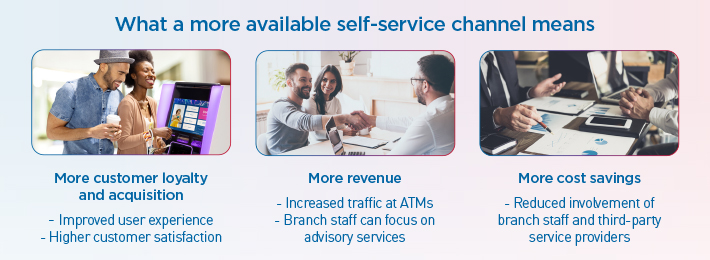

ATMs have never been as crucial to financial institutions (FIs), and the level of importance is set to grow. Indeed, the self-service channel is key to offset a smaller branch footprint and to migrate a growing number of transactions and services from the teller. It is freeing branch staff for more value-added consultative work and helps make branches more cost efficient and profitable. The ATM channel is a key pillar of FIs’ service strategy, and FIs are compelled to offer a high-quality self-service experience. ATM availability is therefore critical to customer satisfaction, and an ATM that’s out of operation is the number one source of frustration consumers have with their bank1. How can FIs change that dynamic?

Audit your ATM estate.

Technology has evolved, and FIs should review the features of their ATM fleet vs. capabilities offered by today’s state-of-the art devices. Here are a few areas to check:

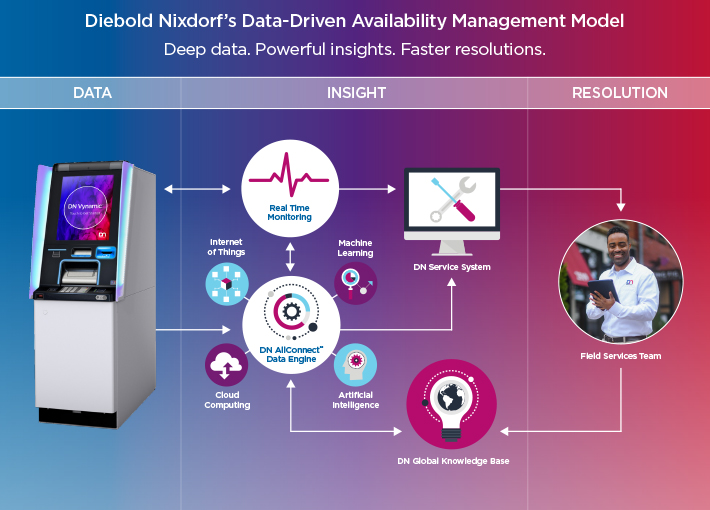

Ensure data intelligence is at the heart of your maintenance model.

Mastering the latest development of IoT, cloud computing, machine-learning and Artificial Intelligence (AI) is a minimum requirement for ATM maintenance. This enables to build a precise and constantly refined profile for every device in the field. So, whenever a service request is open for an incident, the root cause is identified remotely and automatically within seconds, without having to send a technician to inspect it. Also, if a repair by a technician is required to resolve the issue, the on-site visit is planned with the greatest details, including the parts needed and the amount of time it will take to complete the repair. Incidents can therefore be resolved faster with a very high first-time fix rate. Through the analysis of data patterns, trends and leading indicators, an impending failure can also be identified, and a maintenance visit scheduled to avoid a future outage.

Add real-time monitoring capabilities to reach market-leading availability.

Finally, FIs should not depend on end-users to report an out-of-service event and on their staff to raise a service request. Not to mention that ATMs are increasingly located in fully automated branches and off-site where no staff is present. FIs must rely on a remote monitoring solution so any issue in their fleet is detected and reported in real-time, 24/7, and can therefore be resolved faster.

Refresh your network with a device designed and built for high availability powered by the most advanced management solutions.

The DN Series™ family of ATMs beats all records. Bank note jams can be reduced by up to 50% thanks to more accurate banknote separation and a simplified path in the head module. Higher cassette capacity and innovative configuration options, combined with our unique set of expertise in recycling technology, can enable a reduction of CIT visits by up to 60%. When a device is connected to the core enabler of our services, DN AllConnectSM Data Engine, 150 sensors and 100 data points feed our data-driven service model with deep technical data so failures can be either pre-empted or resolved faster. Diebold Nixdorf’s service model was recognized by the Technology & Services Industry Association (TSIA), winning a STAR Award for Best Practice in the Delivery of Field Services. Diebold Nixdorf is also the world’s number one vendor for ATM monitoring software2; FIs that manage monitoring and incident resolution operations in-house can opt for our Vynamic® View software, which is installed on over 600,000 devices. Those pursuing an outsourcing strategy can subscribe to DN AllConnect Managed ServicesSM, currently successfully monitoring the fleet of more than 1,000 banks and credit unions across the globe.

Offer market-leading availability to your self-service channel users with DN Series™. Learn more about our most advanced family of self-service ATMs delivering more personalized experiences in a more integrated solution.

1NielsenIQ International Retail Banking Consumer and Technology Survey commissioned by Diebold Nixdorf

2RBR 2021, ATM Software

First appeared in RBR Banking & Payments Bulletin