In the last part of this two part mini-series, we looked at the need and potential benefits of optimizing the cassette configuration inside your ATMs. In this part we will have a closer look into the how.

How do I find out if my configuration has a potential for improvement, and how do I determine what exactly I need to change? The key word in this context is utilization. Let’s get a little technical for a moment: The weekly utilization rate of a cassette tells us the average note flow in relation to the capacity of a cassette.

What does that mean? If a cassette has a capacity of 3,500 notes and then dispenses 3,500 notes in a week, the weekly utilization rate for this cassette is 100%. The same goes for a deposit cassette in which 3,500 notes were deposited over the course of a week. Again, the weekly utilization rate is 100%.

By the way, if you have several cassettes that dispense the same denomination, you calculate the utilization rate for all of these cassettes combined by summing up the individual capacities. So, a utilization rate above 100% means that a cassette was used more than its capacity could handle at once.

- If it was a dispense cassette it ran empty before the week was over.

- If it is a deposit cassette it was full before the end of the week. In both cases an intervention – likely by the cash-in-transit (CIT) provider – was necessary before the week was over, leading to a high number of CIT visits.

On the other hand, a utilization rate below 100% indicates that fewer notes of the denomination were used than were available. While this can extend the time between CIT visits, simply assigning a high capacity to one denomination may not be ideal. As discussed

in the first blog of this mini-series, consumers now expect to be able to choose their denomination mix at the ATM. Meanwhile, inflation increases the volume of withdrawals, making the addition of higher-value denominations more appealing.

ATM Cassette Configuration Snapshot

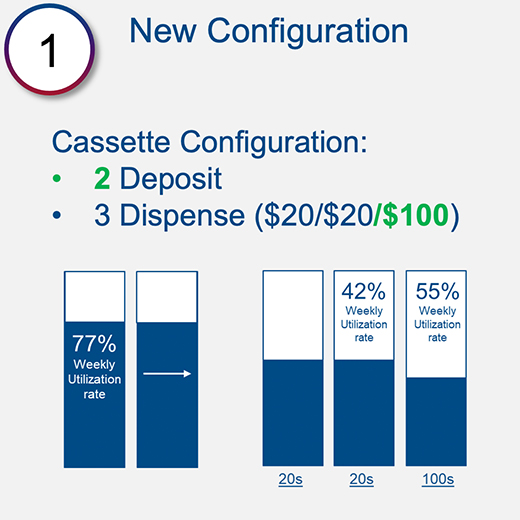

Let’s look at an example to make this knowledge more tangible. In the first image, you see a configuration of an ATM including the weekly utilization rates. This was a cash-in/cash-out device with one deposit cassette and four dispense cassettes that all dispensed $20 notes.

The deposit cassette filled up quite quickly and needed to be emptied every 5.1 days. The dispense cassettes, despite their high capacity, had to be refilled every 9.3 days. This led to about 71 CIT visits every year for this one ATM.

What Was Done to Improve This Configuration?

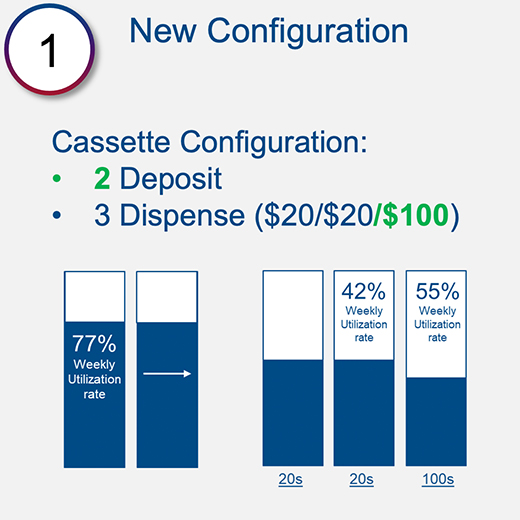

In the second image, you see two main changes were made. To stop the deposit cassette from filling up so quickly, a second deposit cassette was added, doubling the deposit capacity available and lowering the utilization to 77%.

By doing so, capacity for dispense was reduced. To prevent any issues that could arise from the higher pressure, a second denomination was added. Now two cassettes are dispensing $20 notes and one cassette dispensing $100 notes. Thanks to the addition of a higher-value denomination, the utilization rate of the dispense cassettes was reduced as well.

Twenty weeks after switching to the new configuration, this ATM required only 40 CIT visits per year – 31 visits less than previously. Additionally, the higher uptime at the ATM contributed to a 13% increase in weekly transactions.

Additionally, the deposit ratio of this device is now at 50%, which is ideal for enabling cash recycling.

Optimizing Utilization Through Cash Recycling

Let’s have a look at that for a moment—the effect cash recycling can have on the utilization rates of an ATM is considerable. In a pilot program with a customer in the U.S., the switch from cash-in/cash-out to full cash recycling was estimated to lead to a reduction of CIT visits by 81%:

While not every case will have as big an impact as this, for ATMs with a good in-out ratio evaluating whether enabling cash recycling makes sense has a strong potential to improve ATM operations. But even if cash recycling is not on the table (yet) evaluating the efficiency of your current cassette configuration still provides you with improvement potential.

Diebold Nixdorf’s Advisory Services team specializes in analysis like this. If you’d like, we can look at your ATM fleet and evaluate if a change to a different configuration may make sense and if yes, what new configuration may be more profitable. If this sounds interesting to you, please contact your

Diebold Nixdorf representative today.