Showing: 10 items

Refine By

April 01, 2024 | by Diebold Nixdorf

Explore case studies and learn how your peers leverage Diebold Nixdorf banking products and services for their success.

February 28, 2024 | by Michael Engel

In today's financial landscape, integrating financial services seamlessly is key, but legacy banking infrastructure poses challenges, leading to layered solutions and scalability issues. Explore how embedded finance drives innovation, and how overcoming integration hurdles and forming strategic partnerships helps FIs lay the groundwork for banking transformation.

July 24, 2023 | by Joe Myers

Getting the right touchpoints in the right places is crucial in order to keep customers satisfied. As the ATM becomes an increasingly important delivery point for cash services, as well as often acting ‘as the branch’, how can you unlock its maximum potential?

July 10, 2023 | by Joe Myers

With AI, financial institutions can reduce the rate of ATM failures, be better positioned to address the pain points of customers, combat concerns about financial inclusion and provide a service that is built to adapt as economic conditions evolve.

May 01, 2023 | by Matthew Phillips

Many organizations within the industry are re-evaluating who they are, and equally who they want to be for the future. Repositioning banking from transactional to more of a ‘destination of services’ could be the breeding platform for renewed competitive differentiation, facilitated by digital capabilities.

April 03, 2023 | by Helena Müller

By embracing the power of innovation and avoiding commoditization, is it possible to deliver efficient and effective digital services along with a human touch? Or, has the shift gone too far and the ability to truly add value through consumer journeys has been lost?

February 20, 2023 | by Joe Myers

As we head into 2023, Joe Myers, executive vice president, global banking at Diebold Nixdorf, explores some of the key themes having impact and driving change for the banking industry.

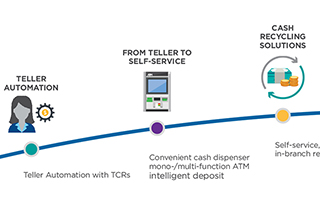

May 03, 2021 | by Ludwig Simoen

In a cash recycling scenario, your own consumers are replenishing your ATMs for free. Are you taking advantage of it?

September 28, 2020 | by Scott Weston

Merely having a deposit-accepting ATM is no longer the most efficient, convenient or fulfilling option for transaction migration. It simply isn’t a good experience for consumers or branch employees, and the cost to FIs for balancing is cumbersome. Deposit Automation technology creates the best overall experience and efficiency for migrating transactions out of the branch… especially with the acceleration of our dependence on self-service through COVID.

September 21, 2020 | by Matthew Phillips

There is plenty of inspiration to be taken from retail-banking landscapes around the globe. It’s a landscape with a lot of moving—and still emerging—parts. But, it’s an opportunity for FIs to flex their capabilities and customer-centricity, and spend time critically assessing how they will evolve their offerings to meet the needs of the (as-yet uncertain) future.

September 16, 2020 | by Jaivinder Gill

Primary digital channels, such as online and mobile, require top notch service and can provide a personalized experience for consumers. But are you struggling to bring that same consistency into your physical channels? This blog explores strategies for modernizing your ATM channel into a fleet of hyper-connected, digital devices of the future.