It’s no secret: the fuel retail market is changing rapidly. The products and services made available through forecourts are continuously evolving, driven by an increased customer demand for convenience. We’ve discussed this already in a

previous article, where we noted that retailers are transforming their business from a fuel-centric to a convenience-centric one. And rightly so: according to the 2020 HIM & MCA Insights UK Forecourt Market Report, only 19% of forecourt shoppers (still) cite fuel as their main reason for visiting a forecourt. And other stats also point in the same direction: the share of fuel sales will continue to decline in favor of non-fuel products.

But what does this imply for customer

loyalty?

Until recently, many fuel retailers fostered brand loyalty mainly by handing out dedicated fuel cards and fleet cards, offering the possibility to accrue loyalty points for each liter or gallon of fuel purchased. These points could then be spent on non-fuel items in the store. However, with the shift in focus from fuel to convenience, the relevancy of these type of fuel-centric loyalty programs is evaporating. Fuel retailers must look for other ways to keep customers coming back, and to distinguish themselves.

Private labels to the rescue?

The increasing prevalence of the convenience culture is driving growth of the forecourt retail market. In response, fuel retailers have started to improve their food and product offerings

(KPMG 2020). To reap maximum benefits of this ‘renaissance’ of the convenience-style shopping behavior, it is noteworthy to see more and more fuel retailers launching their own private labels of fresh food/coffee and other goods for their c-stores. The reason behind this is to differentiate oneself, not just with from other fuel retailers, but also from nearby supermarkets. The competitive playing field has broadened, and new rules apply.

Stocking up to win over new customers

While COVID-19 has caused damage to retailers and oil companies alike, it also offered new windows of opportunity for c-stores. Stock-outs at traditional grocery brands and supermarkets caused consumers to look for alternatives, and often they found newly introduced private label products sold at convenience stores. According to

data from AlixPartners, 65% of U.S. customers have tried new brands during the pandemic, and the majority (4 out of 5 customers) did so because their usual choice was out-of-stock in the grocery store they frequent. So, having the proper stocks shelved and readily available is a make-or-break capability that can put customer loyalty under pressure and eventually change people’s daily habits. Inner-city convenience stores are especially well-positioned to win over the hearts of consumers at the expense of traditional supermarkets, due to their proximity and ability to offer quick in-and-out services for daily supplies and—as a plus—a coffee to-go on the way home.

Top-up shopping and immediate consumption

In a

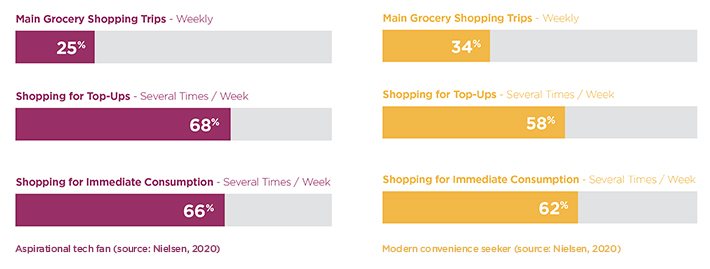

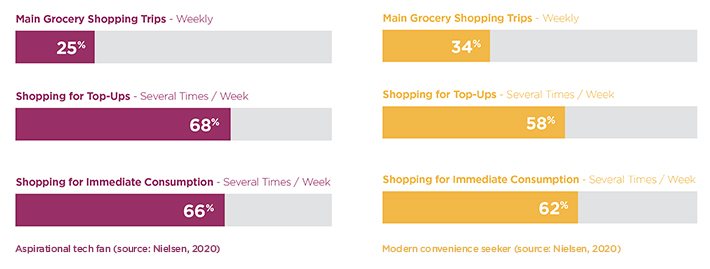

study carried out by Nielsen last year that polled 15,000 grocery shoppers in 15 different countries, six persona types were distilled. Two of them, the ‘aspirational tech fans’ and the ‘modern convenience seekers’, demonstrated behavior that gives convenience stores a leg up compared to more traditional grocery stores. These two customer types, in their mid-30s and living in cities or suburban areas, prefer shopping patterns with multiple short visits to a store to get their daily top-up shopping done. Typically, they combine this with online/digital shopping behavior, as these two types are rather ‘tech savvy’.

Of these two groups about two-thirds indicate they go to stores, typically close-by or during their daily commute, to get additional items (such as fresh produce or items that ran out-of-stock at home) on top of their weekly grocery shopping trips. Also, more than 60% of both segment types visit these stores for immediate consumption, such as snacks, cigarettes or food-to-go. And these non-fuel products yield a high margin (

stat: for the U.S., while non-fuel revenues accounted for only 32% of the outlet revenues, they brought in 63% of the gross margins) which underlines the importance of fostering and building out these types of top-up shopping trips. Building trust and loyalty with these two customer groups may pay off for years to come, provided the retail stores continue to deliver satisfying consumer engagements by offering good quality products, ready-to-pick stocks and fast

self-service including BOPIS and BOPAC.

Personalization in loyalty programs

Clearly brand loyalty—especially in a fuel & convenience setting—goes deeper than just handing out the smartest rewards and most appealing offers. It’s essential to combine private label products, stocked-up shelves and fast and convenient forecourt services with a comprehensive loyalty program that enables you to learn what customers want, and encourage them to come back.

Studies show that key drivers in loyalty programs are rewards, surprises and personalization. Many consumers still seek discounts and free products as a reward for their participation in loyalty programs. They also like surprise offers and unexpected gifts, both of which strengthen the emotional connection a consumer feels with a brand. In the end, consumers expect appreciation for being loyal and supporting the brand by purchasing products or services. They want to engage in a relationship with a brand and be treated as an individual rather than a ‘number’.

Personalization is an important element in driving successful loyalty programs. In consumer journeys, interactions via the loyalty program form an integral part of the entire customer brand experience. It is therefore essential to ‘connect the dots’ between previous and current consumer engagements, regardless of whether they took place in a digital or physical store environment. Such a ‘holistic view’ of each individual customer will help tailor real-time promotions and offers that are relevant to them. It also gives retailers the opportunity to analyze behavioral patterns per region and even per store, to learn from this and anticipate emerging trends in their key customers’ shopping behaviors. Leveraging and combining previous interactions, regardless of channel or touchpoint, fuel & convenience retailers will be able to drive home their unique benefits, keep customers satisfied while adapting to consumption patterns well

on time

For additional information on Vynamic Engage watch this

short video.