Occasionally, a technological advancement propels financial institutions to think beyond the current state and envision its approach to the future. In this case, it’s the availability of Windows 11 IoT Enterprise LTSC 2024 (Windows 11). As change is prevalent in the industry, every FI may approach the future differently; however, ensuring a stable, scalable long-term platform is top-of-mind for all.

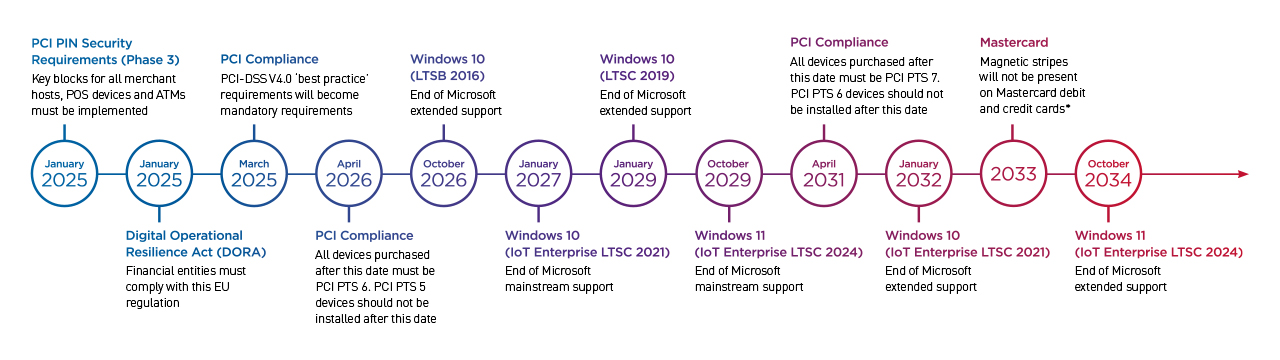

In the next few years, FIs will face mandatory changes to their self-service channel. A mix of payment card industry (PCI) compliance requirements, technology shifts and supplier support may necessitate new software or hardware components.

Mapping your technology journey has never been more critical, and understanding the requirements it will have on your hardware, software, encrypted PIN pads (EPPs) and back-end transaction systems is paramount.

As a trusted partner and advisor, Diebold Nixdorf has identified roadmaps, timelines and requirements that can help alleviate some of the stress and burden of these technological changes. It’s our job to assure our clients that we have the tools and insights to drive innovation in a way that makes sense for their organization.