This is part two in a three-part blog series on redefining your ATM strategy for the modern banking ecosystem.

Read part one here.

For the second part of this blog series, we want to dive into the minutia of data analytics. Don’t worry, it isn’t as complicated as it sounds, but many financial institutions (FIs) do not have the resources needed to solve this puzzle. You may—or may not!—be surprised to hear that at DN, we work with banks around the globe on data capture and analysis to help improve ROI and drive efficiencies. It’s a natural fit when we can be so plugged in at every level, from hardware to software and services.

Where to start? With your consumers, of course.

Getting to know your specific consumers’ desires is a critical part of constructing the right ATM strategy. Without that knowledge, you may spend valuable time and money investing in the wrong technology or placing your off-premise ATMs in sub-optimal locations.

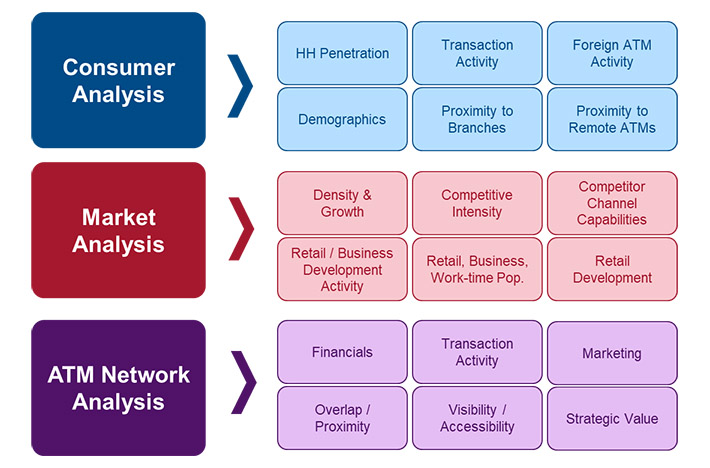

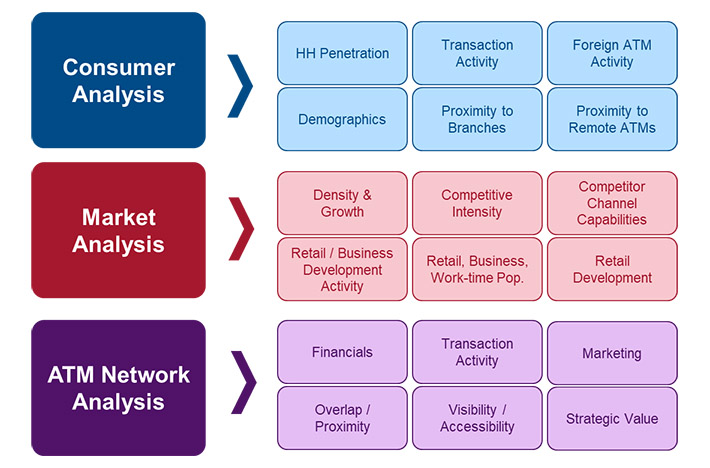

When building your foundation, there are three main buckets of information that you need to consider. Each are equally important, yet very different. Careful analysis of these components will reveal areas of strength and areas for improvement in your ATM network. These three components work together to triangulate the optimal decisions.

#1: Consumer Analysis

#1: Consumer Analysis

The first component is centered around understanding your consumers and how they currently interact with your branches and ATMs. We need to build a complete and detailed profile for each and every consumer.

During this exercise, the goal is to develop a thorough understanding of your consumers’ channel preferences and current transaction behavior in order to identify opportunities for additional efficiency improvements. This will determine the ‘what’ question: What types of transactions sets do I need to offer my consumers and what features and functionalities are best suited for each ATM location?

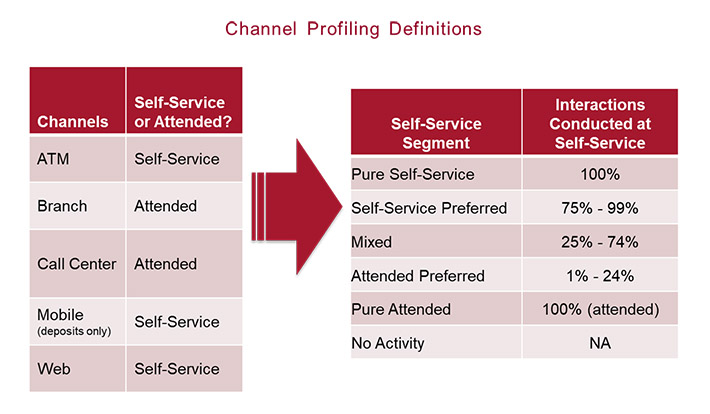

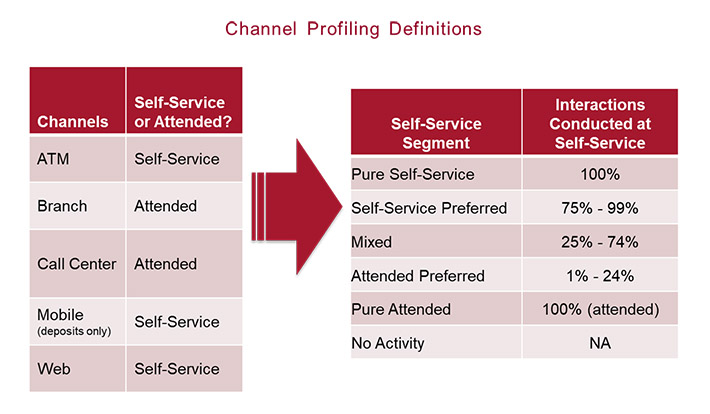

First, create a channel profile for each consumer based on how they are currently transacting. Best practice is to break these down into five self-service segments. These range from ‘Pure Self-Service,’ where a consumer conducts all their transactions at a self-service channel (ATM, Online and/or Mobile), to ‘Pure Attended,’ where a consumer uses ONLY attended channels or transactions (Branch and/or Call Center). Then there are the middle tiers where the majority of consumers will likely fall.

Now that we know how our consumers transact at a high level, let’s drill down another layer to see the disparities between age segments. The age splits that you use internally may differ from others, but in general best practice is to use the common generational definitions: Gen Z, Gen Y, Gen X, Younger Boomers, Older Boomers and the Golden Generation.

Whatever you use is okay, as the point of this exercise is to understand at a deeper level how specific consumer groups are transacting with your channels. The goal is to ensure your channel offering is congruent with the expectations of the distinct age cohorts, which will include a mix of attended and self-service options.

Further consumer analysis revolves around understanding where your consumers live in relation to your branch and ATM networks. How convenient are your touchpoints to them and which locations are they using? On average, we tend to see that consumers use about 2.5 different locations per year, meaning they view your network in their market as their branch or ATM.

Consumer cross-site usage is usually much higher than FIs expect it will be, underscoring the need to understand this metric so you know where branches and ATMs are actually needed, and where there may be opportunities for removals.

Where are your consumers using their PIN-based debit cards? Where are they making withdrawals at foreign ATMs? Using settlement files, you can summarize this information and even plot them on a map against your physical network and consumer households. Very quickly you’ll see network gaps where an off-premise ATM would be viable. But beyond that, you need to know what functionality is needed at that off-premise ATM.

This is where additional consumer analysis is needed to measure the specific transaction behaviors of each consumer and how they vary based on their demographics.

#2: Market Analysis

The market analysis component centers around the demographics and competitive environment in the market, especially as it relates to determining the best locations for off-premise ATM placement.

From a demographic perspective, where is the household growth occurring? Where are the consumers that match your existing consumer base? This is important as the placement decisions you are making today are long-term investments. You need to be sure you have a clear view of what the market will look like down the road.

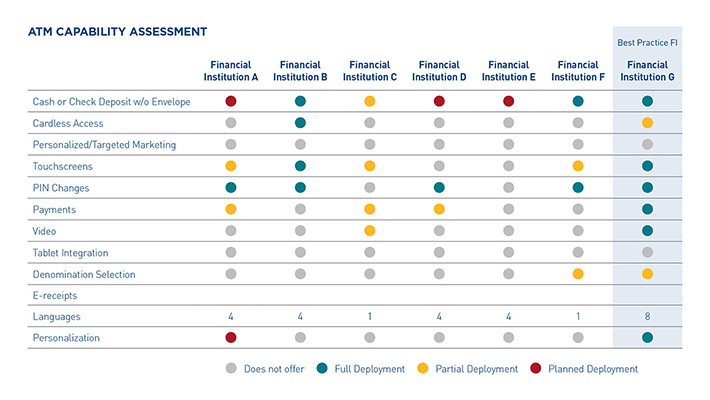

From a feature/functionality perspective, you want to use the information collected in the consumer analysis component to tie it back to a competitive assessment of the market. You already know what functionalities you offer, but what about your competitors?

Being the first to market with a specific product or capability can be a huge benefit. But knowing what your gaps and deficiencies are is just as important.

#3: ATM Network Analysis

Shifting the mindset away from the ATM channel as a cost center, to the ATM channel as a revenue generator, is not easy. FIs that have the cost center mentality see the network through a number’s perspective. How much does it cost and how much in surcharge fees can we collect?

Even with this mindset, after working through the thorough analysis outlined above, FIs will be able to see how small investments in their ATM channel can yield large dividends later. When they begin to see the numbers and ROI, that mindset has a tendency to shift—now they want to continually push the channel forward to gain more efficiencies.

The results of the other components can now be brought into this portion of the analysis. We can measure the performance and usage of each ATM and compare that to the consumer and market recommendations. Here, we are able to bring in the profitability potential of the ATM and determine what we need to optimize it. Can your current partner do all that?

In the

final part of this blog series, we will dive into the final step of a modern ATM strategy: Deploying the terminals in the right place.

Learn more about how DN can support your organization holistically.

Start here.