Closing the blinds remotely, watching a package delivery through the doorbell cam, tracking activities via our smartwatches―these capabilities have become part of the new normal of our daily lives. And we’ve come to expect our financial institutions (FIs) and retailers to offer the same convenience through on-demand, digital-first services.

It can be hard to recall what it was like before we had these capabilities. Even so, connectivity and interoperability are still the new kids on the block. While we know they’re driving a permanent shift of consumer journeys, they continue to rapidly evolve. And that makes it increasingly difficult to predict what the IT landscape may look like even in the near-term future. What we’ve all experienced during the last months and the response to COVID-19 show us just how quickly and radically things can change.

For example, Zoom has become the poster child of the pandemic’s impact on technology. Interest in the video conferencing solution has surged during the crisis. In March, Zoom reported 200 million daily users, which was 20 times its usage rate of 10 million in December 2019.

The role of video conferencing solutions in transforming our work life in the “new normal” is similar to the position the ATM has taken to enable FIs to deliver the kind of experience consumers increasingly expect. Early in 2020, the ATM became, overnight, the only physical gateway to many FIs. It helped overcome temporary branch closures, and it gave consumers a safer way to interact with their FIs while minimizing health risks. Because so many consumers were looking for alternatives to entering the branch and physically interacting with staff, they embraced the migration from counter activities to the self-service channel. And, like Zoom, use of the ATM surged.

Leveraging the ATM as a bridge between the physical and digital

While the developments of 2020 have certainly accelerated the shift toward digital, we still see a mix of payment options―both cash and noncash―being used. For both options, the ATM is a frequently used touchpoint and plays a key role in consumer, business customer and bank staff journeys. In fact, many consumer banking journeys now begin at the ATM. It functions as a central entry point for cash and noncash transactions, making it a critical banking channel and a valuable brand ambassador.

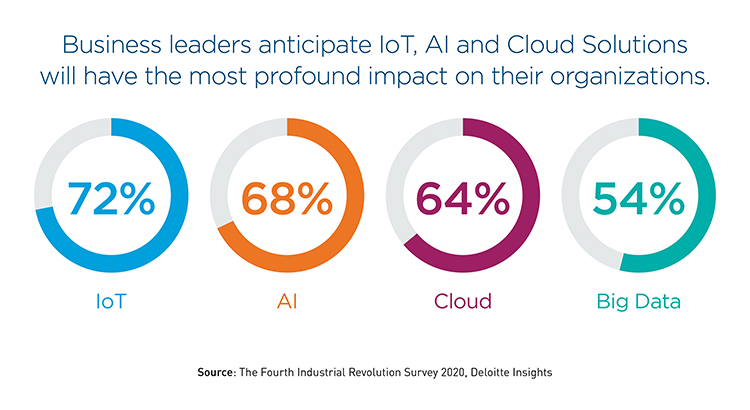

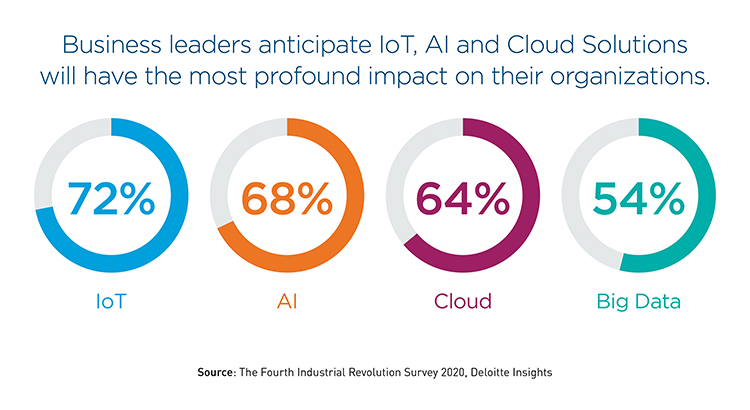

Beyond serving as a point of entry, the modern ATM plays a significant role in the banking automation journey. It is an optimal bridge between the physical and digital worlds. To strengthen this bridge, Diebold Nixdorf believes that the banking industry in general and the ATM channel in particular has a lot to gain from the continued proliferation of IoT technology. Already, it is improving connectivity across the self-service channel. And data show that business leaders overwhelmingly expect IoT will continue to transform their organizations.

Evolving self-service to meet changing consumer demands and service needs

Evolving self-service to meet changing consumer demands and service needs

The three realities of today’s environment―more demanding consumers, growth in the population of digital natives and older generations that are becoming more comfortable with digital channels―are placing FIs under more pressure than ever. They must deliver speed, personalization and instant satisfaction through online/mobile self-service channels. They must embrace their agility to be “always on” in the most cost-effective manner. And they must effectively allocate resources and be prepared to scale whenever needed.

In the IoT in banking world, new technology and new operating models provide the most effective, efficient, sustainable path to agility and scalability. That means that in this new world, FIs must let go of legacy systems. To enable FIs to offer an advanced transaction set―like pre-staged transactions that allow consumers to use self-service “in the branch” or “as the branch”―Diebold Nixdorf has already broken away from the traditional, channel-centric approach. That’s how we’re helping FIs across the globe accelerate the digital/physical user experience and more efficiently manage their entire self-service operation.

IoT in banking and the advancements that come with it are facilitating a move toward a richer user experience. Diebold Nixdorf solutions use APIs and cloud-native technology to create an open, standards-based platform to modernize FIs and create dynamic, connected banking journeys for today’s digital-first, cloud-enabled environment. This approach allows for the seamless introduction of new capabilities―including a more open ecosystem for the partnerships that are integral to building new products, services or functionality.

These advancements and the Diebold Nixdorf approach also create a more proactive service model. We have better tools and better insights to maximize availability and connectivity, as well as optimize management. Based on data transparency, Diebold Nixdorf can offer FIs customized, targeted and proactive services for ATM management. Using this model, we can advise FIs about system performance, cash inventory―down to the denomination―recycling quotas and more. And all in nearly real time. It ensures operations management is easier and more efficient than ever before.

Details make the difference

The more we know about the device that is in the field, the modules installed and its usage patterns, the easier it is to get the right technician, to do the right fix, with the right part, at the right time. Powered by DN AllConnect Data Engine

SM, our services team streams and aggregates system data from a terminal’s internal sensors to take faster, more informed actions that keep ATMs up and running at the highest levels of availability. Tens of thousands of devices are already leveraging this IoT capability today. Improved connectivity gives us access to these details and, ultimately, the insight helps drive very high uptime and very high quality of services for an FI’s consumers. The data drives the service. And the service drives the impact on consumers’ levels of satisfaction and trust in their FIs. The technology, the approach, the channels, the data and the ATM service all come together to maximize connectivity and deliver the seamless experiences today’s consumers expect.

Are you prepared for the IoT business transformation?

Let’s connect!