This is the final post in a three-part blog series on redefining your ATM strategy for the modern banking ecosystem. Read

part one here and

part two here.

In the previous two blogs in this series, we’ve looked at the importance of the ATM to the overall channel delivery strategy. I’ve also explored, at a high level, the importance of understanding the data to drive the recommendations.

In this final segment, I want to focus on optimizing your ATM network from a placement perspective. It’s critical to ensure you have the right number of ATMs in the market and that they are optimally positioned, in able to get the most out of your network.

We have already defined the role of the ATM to the FI, but how do we define the role of the ATM to the consumer? The answer is pretty straightforward: they want convenience. The consumer wants the ability to conduct their transactions how, when and where they want, in the way that is most convenient for them.

FIs that have a robust branch network with 24/7 available ATMs are in good shape. FIs that have this robust branch network AND complementary off-premise ATMs are in much better shape.

A Cohesive Look at Channel Strategy is Required for Modern Banking

Off-premise ATMs create a more attractive delivery network that can have a direct impact on your ability to attract new consumers and retain and grow wallet share with existing consumers.

Undersized branch networks can be augmented by the addition of well-positioned ATMs in key retail and/or destination points. The addition of ATMs will create the critical mass required to capture more share as well as increase convenience for existing consumers.

The largest U.S. banks have been using this strategy for many years. We are now seeing many community banks and credit unions adopt the same strategy.

When you think of the branch and ATM network through your consumers’ eyes, what do you see? We see touchpoints that are convenient for the transactions your consumers need to complete. Since ATMs offer functionality for at least 60% of all transactions (deposits and withdrawals) and up to 90% with interactive video or core connectivity, the consumer will use that ATM because it satisfies their transaction needs.

FIs that use the off-premise ATM as part of their location strategy can actually create more value for consumers in that market, gain more market share and have LOWER overall costs!

Here is an example…

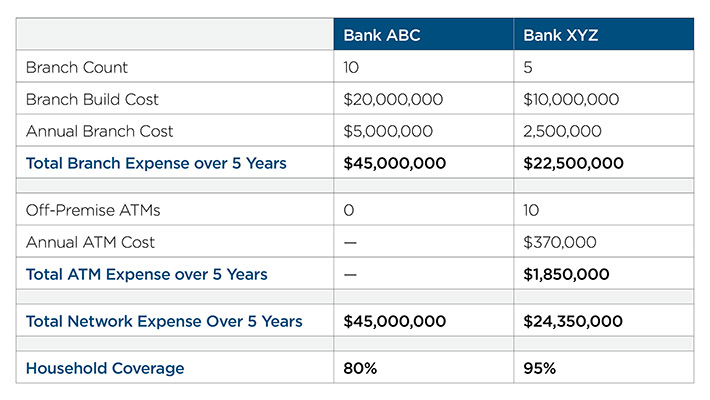

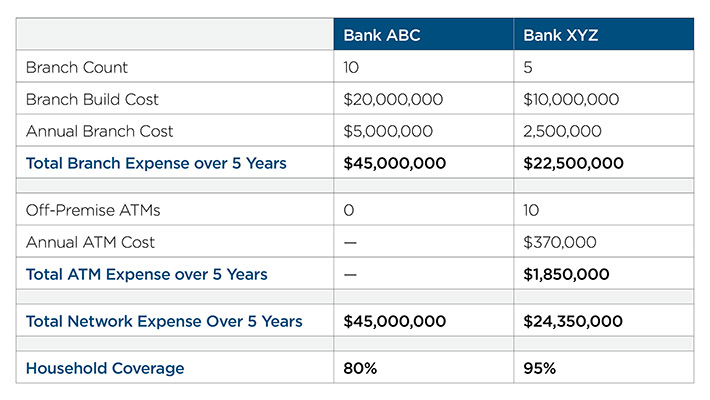

ABC Bank opened 10 branches to fully cover their market. They do not have any off-premise ATMs. They want to be seen as ‘convenient’ to the entire population and currently have 80% household coverage. This means that 80% of the population lives within two miles of one of their branches. Each branch costs roughly $2 million to build and roughly $500,000 to maintain and operate on an annual basis.

XYZ Bank took a different approach. They only opened five branches and complemented those locations with 10 off-premise ATMs. In doing so, they are able to cover more geography and have 95% household coverage. Each branch costs the same as ABC Bank, but the off-premise ATM costs are a fraction of the branch costs. Costs will vary by market, but let’s assume their average lease rate is $30,000 per year and the cost of the ATM is $7,000 per year, amortized over 5 years.

What does this comparison look like?

Which bank would you rather be?

Yes, this is a simple example, but it comes from an actual project we worked on for a customer. Again, think about this from a consumer’s perspective. With XYZ Bank, they have 15 locations throughout the market. Consumers don’t necessarily think in terms of branches and ATMs, they think about convenience and the ability to conduct transactions, quickly and easily.

Even though ABC Bank is larger in terms of branch share, XYZ Bank has given the consumers in the market the perception that they are the larger bank. They are achieving more household coverage, at nearly half the cost! This may not surprise you now, but the real XYZ Bank has more deposit share in this market than ABC Bank because they incorporated an ATM strategy into their overall physical delivery strategy.

Choosing the right location

Location, location, location… We hear it all the time from businesses. We hear it because it is true—and it’s no different for off-premise ATMs. The actual location matters a lot.

The objectives of off-premise ATMs are to complement the branch network and expand the household coverage and convenience for your consumers in that market. Implemented properly, off-premise ATMs offer three key benefits:

1.

They enhance consumer convenience

2.

They promote your brand and influence account acquisition

3.

They generate surcharge and interchange revenue

The two types of off-premise ATM locations

“Strategic value” off-premise ATMs are defined as highly visible, publicly accessible locations that are conveniently located in a dense employment or population area, have strong retail traffic drivers and/or are near major public transportation arteries. These types of locations are great branding and marketing opportunities for consumer acquisition and retention as they are seen by thousands of consumers every day.

“Relationship-based” off-premise ATMs are defined as ATMs that are located at sites that have limited visibility and accessibility to the general public, often times serving a captive audience. These locations are typically in buildings of business customers, office buildings, hotels, universities or cultural buildings (museums, sporting arenas, etc.).

The difference in performance between these types of locations is stark. Strategic value locations hold much more opportunity than relationship-based locations, and thus all off-premise ATMs should be placed with this in mind. Sometimes, relationship-based ATMs are needed, but they shouldn’t be considered for expanding the market or increasing household coverage due to their limited nature.

Finding the strategic value locations means looking at the main retail nodes in the market. The best locations are situated where your consumers are going on a daily basis for their everyday shopping needs. These types of locations are typically grocery stores, Wal-Mart and other major retail shopping centers.

Once an ATM is located in these areas, the convenience factor is enhanced because the consumers are already in these areas shopping. This is one part of having quality sites. Not only is the quantity of good retail important, the quality of retail is equally as important.

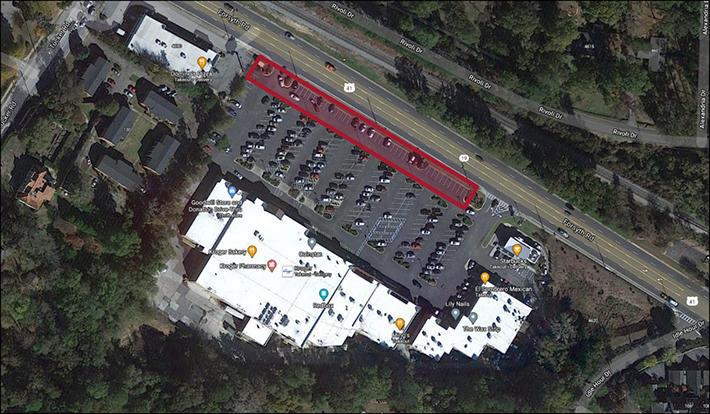

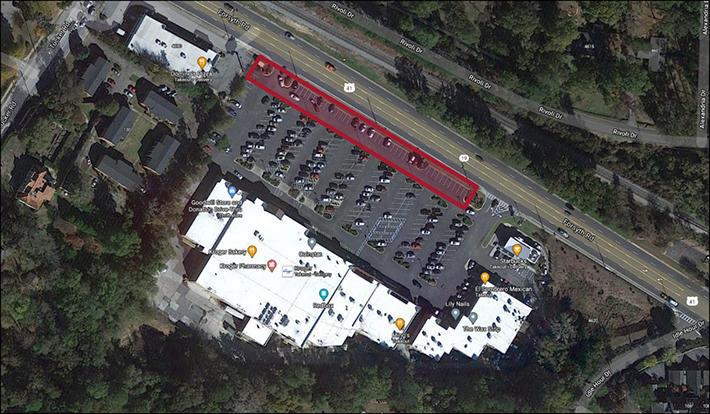

Once you find the right area, now it is time to find the right site. Measuring the visibility and accessibility of each potential placement is extremely important. If you deploy an off-premise ATM in the parking lot of the major grocer, that is great! But if you place it on the side of the parking lot with little to no visibility, you won’t get as much usage since it is not as accessible.

Strong visibility means being able to see the ATM from the main road on approach, void of any sight line barriers blocking the view. High accessibility means it is easy for the consumer to enter the area and easy to navigate to the ATM. Locations with a “high site quality score” typically perform 3-5 times better than those with low scores!

Here is an example of a prime off-premise ATM location with high site quality scores. This example shows a recommendation that is located in the parking lot of the main grocer in the submarket. You can see in the red box the preferred placement of this ATM. It is located along the main road with maximum visibility and easy access.

As you can see, a robust ATM strategy has many moving parts, and it’s often more complex than many FIs realize. Our experienced Advisory Services team has optimized every step in the path.

Connect with us today to get your modern ATM strategy off the ground!