February 21, 2024 | MATT DUNLAP

When we think about the role of branches and cash in branches, we must consider several factors. First, what is the demand for cash? Despite the growing popularity of digital transactions, cash is still very much alive. Over the past 20 years, the volume of US banknotes in circulation has steadily increased year over year. In the ten years from 2012 to 2022, we can see a 64% increase to 54.1 billion banknotes in circulation, making it quite clear that there is still a high demand for cash.

Next, we need to consider how this cash is being used. Generally, we see that the share of cash as a payment rebounded slightly in 2021, especially when you look at small-value purchases where it is still the key payment method. Then there is the fact that cash use varies by age and income: lower income and older age segments have a higher dependency on cash and should not be cut off. Lastly, we see that despite a strong migration to digital channels, there is still a high portion of consumers who prefer to utilize physical channels and to have access to cash. From these facts, we can derive that access to cash will remain important for meeting customer expectations and maintaining inclusiveness for certain segments.

So, what has been going on in the branches? From 2012 to 2022 the hourly pay rates, including salary and benefits, have increased consistently with a 35% increase within the same timeframe. This is in part an effect of branches hiring staff to handle more complex transactions and consultancy tasks. Meanwhile, teller transactions have indeed decreased as many of these simpler cash transactions have been migrated to the self-service channel. Consequently, the labor costs per transaction have increased by 59% over these 10 years. However, 89% of consumers in the USA still find branches either useful or essential – a clear indication that the model of the bank branch is still in high demand.

Amid these trends, it is clear that financial institutions need to consider additional ways to reduce costs and/or increase revenue opportunities.

Luckily, there is a solution for this issue: teller automation. Strictly speaking, teller automation has existed for a while, but some new and exciting developments further improve its efficiency and benefit to the branch.

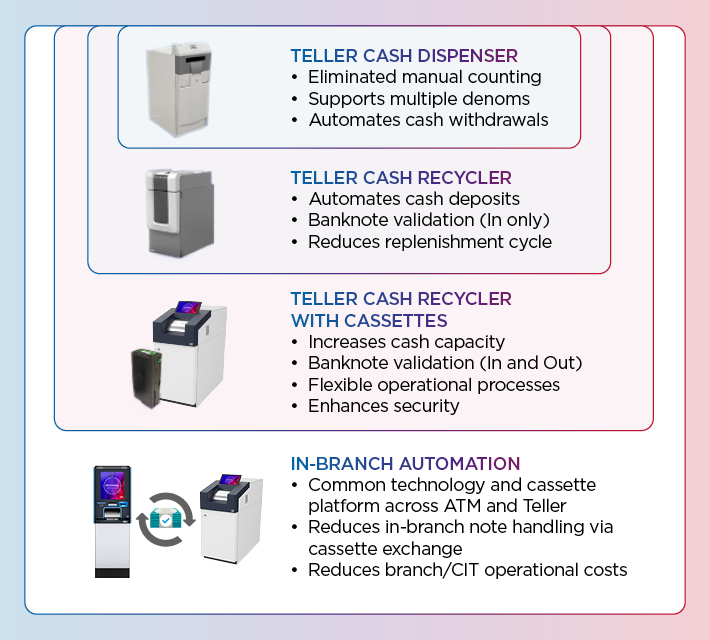

Technology has been an important asset to simplify teller transactions for a while, and the technology we use has become more sophisticated over the years. From monofunctional dispensers that secured the cash in a safe compared to the previously used cash drawer and automated withdrawals to teller cash recyclers (TCRs) that also automated cash deposits and the validation of notes, thus expanding the time between replenishments.

Now technology is taking another step and at the same time, preparing for the next one: Modern teller automation devices like the DN SeriesTM 600V store banknotes in cash cassettes – the same as an ATM does. Compared to the previously used drums this offers a few benefits:

In addition to these benefits, the use of cassettes inside the TCR enables the next step in the development of cash handling within the branch: in-branch cash automation. By utilizing the same technology and cassettes in both the ATMs and the TCRs, cassettes can ultimately be shared from one device to the other. Apart from simplified service interventions and maintenance, this greatly reduces the need for note handling within the branch – a benefit from both an operational efficiency and security standpoint. Additionally, the number of CIT visits can also be reduced leading to reduced operational costs per branch.

Additionally, the 600V TCR leverages the power of the DN All ConnectSM Data Engine to provide real-time metrics for improved servicing and maintenance as well as insight into optimizing the device configuration for each unique teller environment.

Meanwhile, tellers gain time to focus on more important tasks: Serving their customers and supporting them with complex financial decisions. This not only creates the opportunity for increased revenue through cross- or upselling but also improves customer relationships, which can positively influence retention.

Teller automation has already proven greatly beneficial to streamlining teller transactions. With cassette-based storage enabling the way to in-branch cash automation, it is on route to revolutionizing cash handling in the branch once more. If you’d like to learn more, visit us at DieboldNixdorf.com/TellerAutomation.

Listen as Matt Dunlap discusses the efficiency gains, security enhancements, and time savings measures that teller automation bring to financial instituions.

VIDEO ANSEHEN