Showing: 4 items

Refine By

April 01, 2024 | by Diebold Nixdorf

Explore case studies and learn how your peers leverage Diebold Nixdorf banking products and services for their success.

July 24, 2023 | by Joe Myers

Getting the right touchpoints in the right places is crucial in order to keep customers satisfied. As the ATM becomes an increasingly important delivery point for cash services, as well as often acting ‘as the branch’, how can you unlock its maximum potential?

July 10, 2023 | by Joe Myers

With AI, financial institutions can reduce the rate of ATM failures, be better positioned to address the pain points of customers, combat concerns about financial inclusion and provide a service that is built to adapt as economic conditions evolve.

May 03, 2021 | by Ludwig Simoen

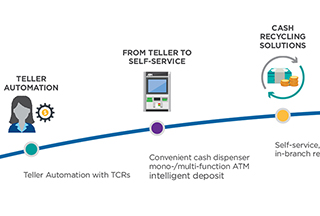

In a cash recycling scenario, your own consumers are replenishing your ATMs for free. Are you taking advantage of it?

September 28, 2020 | by Scott Weston

Merely having a deposit-accepting ATM is no longer the most efficient, convenient or fulfilling option for transaction migration. It simply isn’t a good experience for consumers or branch employees, and the cost to FIs for balancing is cumbersome. Deposit Automation technology creates the best overall experience and efficiency for migrating transactions out of the branch… especially with the acceleration of our dependence on self-service through COVID.